Full coverage car insurance in united states takes center stage, promising a rollercoaster ride of insights and tips to navigate the complex world of insurance with ease and confidence.

Buckle up as we dive into the nitty-gritty details of full coverage car insurance and uncover the secrets to finding the best deals in the vast landscape of insurance providers.

Overview of Full Coverage Car Insurance in the United States

Full coverage car insurance in the United States provides comprehensive protection for drivers and their vehicles. This type of insurance typically includes both liability coverage and coverage for physical damage to your car.

Components of Full Coverage Car Insurance

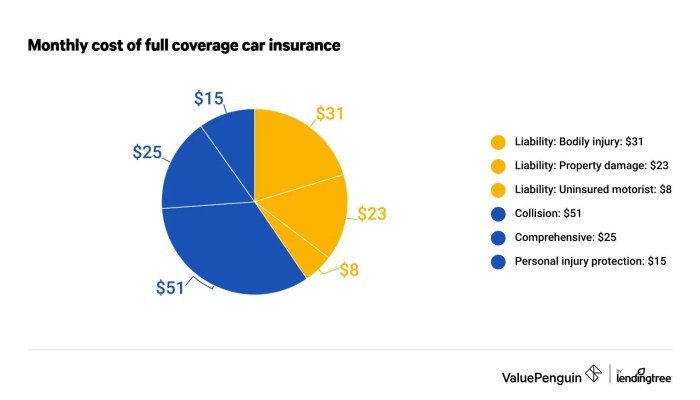

- Collision Coverage: This component covers the cost of repairs to your vehicle in the event of an accident, regardless of fault.

- Comprehensive Coverage: This covers damages to your car from non-collision incidents such as theft, vandalism, or natural disasters.

- Liability Coverage: This protects you if you’re at fault in an accident and covers the other party’s medical expenses and property damage.

- Uninsured/Underinsured Motorist Coverage: This component provides coverage if you’re in an accident with a driver who doesn’t have insurance or enough coverage.

Benefits of Full Coverage Car Insurance

Full coverage insurance is recommended for drivers in the United States because it provides extensive protection in a variety of situations. For example, if you have a newer or more valuable vehicle, full coverage can help cover costly repairs or replacements.

Additionally, full coverage can provide peace of mind knowing that you have comprehensive protection in case of an accident.

Cost Comparison with Basic Liability Insurance

While full coverage car insurance tends to be more expensive than basic liability insurance, the added protection and peace of mind may outweigh the cost difference for many drivers. Basic liability insurance only covers the other party’s expenses in an accident where you are at fault, while full coverage protects your vehicle as well.

Filing a Claim with Full Coverage Insurance

When filing a claim with a full coverage car insurance policy, you will need to contact your insurance provider and provide details about the incident. The insurer will then assess the damages and provide compensation according to the terms of your policy.

Common Misconceptions about Full Coverage Insurance

One common misconception is that full coverage insurance covers everything. In reality, there may be certain exclusions or limits to coverage, so it’s important to review your policy carefully.

Finding the Best Deals on Full Coverage Car Insurance

To find the best deals on full coverage car insurance, it’s essential to compare quotes from different providers. You can also consider factors like discounts, deductibles, and customer reviews to make an informed decision on the right policy for your needs.

State-by-State Variations in Full Coverage Requirements

When it comes to full coverage car insurance in the United States, each state has its own set of minimum requirements that drivers must adhere to. These requirements can vary significantly from one state to another, impacting both the coverage drivers receive and the premiums they pay.

Minimum Requirements for Full Coverage

- In California, drivers are required to have a minimum of $5,000 in property damage liability and $15,000/$30,000 in bodily injury liability.

- On the other hand, in Florida, the minimum requirements are $10,000 in personal injury protection (PIP) and $10,000 in property damage liability.

- States like New York have higher minimum requirements, with drivers needing $25,000/$50,000 in bodily injury liability and $10,000 in property damage liability.

Comparing Variations in Full Coverage Requirements

- Some states have no-fault insurance laws, requiring drivers to carry PIP coverage regardless of who is at fault in an accident.

- States with higher minimum requirements tend to have higher insurance premiums, while those with lower requirements may offer more affordable coverage.

Impact on Drivers and Premiums

- Drivers in states with higher minimum requirements may have more comprehensive coverage but pay higher premiums.

- States with lower requirements may have more drivers who are underinsured, leading to potential financial risks in the event of an accident.

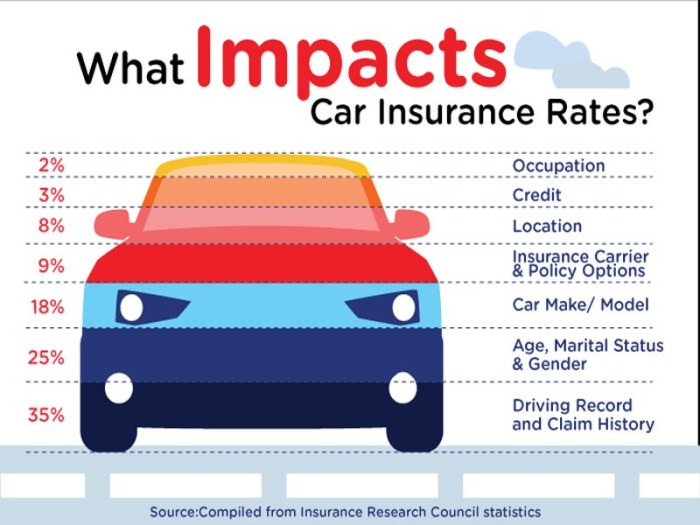

Factors Influencing Full Coverage Car Insurance Costs

When it comes to full coverage car insurance, several factors come into play when determining the cost. Understanding these factors can help individuals make informed decisions when choosing their coverage options.

Personal Driving History

Maintaining a clean driving record is crucial when it comes to determining full coverage insurance premiums. Accidents, traffic violations, and DUIs can significantly increase insurance costs due to the higher risk associated with these drivers.

Type of Vehicle and Coverage Limits

The type of vehicle being insured and the coverage limits selected also play a significant role in determining insurance costs. Luxury cars, sports cars, and high-performance vehicles typically have higher insurance premiums due to the increased cost of repairs and the likelihood of theft.

Age and Gender

Age and gender are other factors that can impact full coverage insurance rates. Younger drivers, especially teenagers, are considered high-risk drivers and may face higher premiums. Additionally, statistics show that males tend to have higher accident rates than females, leading to varying insurance costs based on gender.

Location of the Insured Individual

The location of the insured individual can also impact the cost of full coverage car insurance. Urban areas with higher rates of traffic congestion and crime may result in higher premiums compared to rural areas with lower risk factors.

Credit Score

Credit score is another important factor that insurance companies consider when calculating full coverage insurance premiums. Individuals with lower credit scores may be deemed higher risk and could face higher insurance costs as a result.

Benefits of Full Coverage vs. Liability-Only Insurance

When it comes to car insurance, one of the key decisions you’ll need to make is whether to opt for full coverage or liability-only insurance. Full coverage typically includes both liability and comprehensive/collision coverage, offering more extensive protection for your vehicle.

On the other hand, liability-only insurance only covers damages and injuries you cause to others in an accident. Let’s explore the benefits of full coverage compared to liability-only insurance.

Comprehensive Protection

Full coverage insurance provides comprehensive protection for your vehicle in various scenarios, such as accidents, theft, vandalism, and natural disasters. With liability-only insurance, you would not have coverage for damages to your own vehicle in these situations.

Financial Security

Having full coverage insurance can provide you with financial security in the event of an accident. For example, if you were to get into a collision with an uninsured or underinsured driver, your full coverage insurance would help cover the costs of repairs or medical expenses.

With liability-only insurance, you would be responsible for these expenses out of pocket.

Vehicle Value Consideration

If you have a newer or more valuable vehicle, opting for full coverage insurance can help protect your investment. In the event of a total loss, such as in a severe accident, full coverage insurance would typically provide you with the actual cash value of your vehicle.

Liability-only insurance would not provide you with this coverage for your own vehicle.

Peace of Mind

Full coverage insurance can offer you peace of mind knowing that your vehicle is protected in a wide range of situations. Whether it’s a minor fender bender or a major accident, having full coverage can help alleviate the financial burden and stress associated with vehicle repairs and medical expenses.

Understanding Deductibles and Coverage Limits

When it comes to full coverage car insurance, understanding deductibles and coverage limits is crucial in determining the level of financial protection provided by your policy.

Definition of Deductibles and Coverage Limits

In the context of full coverage insurance, a deductible is the amount of money you agree to pay out of pocket towards a claim before your insurance coverage kicks in. Coverage limits, on the other hand, refer to the maximum amount your insurance company will pay for a covered claim.

Impact of Deductibles and Coverage Limits on Premiums

Deductibles and coverage limits directly impact your insurance premiums. Higher deductibles typically result in lower monthly premiums, while lower deductibles lead to higher premiums. Similarly, higher coverage limits mean more comprehensive protection but also come with higher premium costs.

Choosing Appropriate Deductibles and Coverage Limits, Full coverage car insurance in united states

When selecting deductibles and coverage limits, it’s essential to consider your financial situation and risk tolerance. Opting for higher deductibles can help lower your monthly premium but may require you to pay more out of pocket in the event of a claim.

On the other hand, choosing higher coverage limits can provide greater financial protection but also increase your premium costs.

Impact of High and Low Deductibles on Premium Costs

- High Deductibles: Lower monthly premiums but higher out-of-pocket costs during a claim.

- Low Deductibles: Higher monthly premiums but lower out-of-pocket costs when filing a claim.

Financial Protection and Coverage Limits

The coverage limits you choose determine the maximum amount your insurance company will pay for a claim. Higher coverage limits offer more extensive protection against costly damages or liabilities, providing greater peace of mind in case of an accident.

Are you looking to compare car insurance rates in the United States? Look no further! Check out this comprehensive guide to car insurance rates comparison in the United States and find the best deal for your needs. Don’t waste time searching through countless websites when all the information you need is right here!

Illustrative Examples of Deductibles Impact

For instance, if you have a $500 deductible and file a claim for $2,000 in damages, you would pay the $500 deductible, and your insurance would cover the remaining $1,500. However, if your deductible were $1,000, you would need to pay more out of pocket.

Typical Deductibles and Premium Costs

| Deductible Amount | Impact on Premium Costs |

|---|---|

| $500 | Higher premium costs but lower out-of-pocket expenses |

| $1,000 | Lower premium costs but higher out-of-pocket expenses |

| $2,000 | Even lower premium costs but significant out-of-pocket expenses |

Choosing Higher Coverage Limits for Better Protection

Opting for higher coverage limits is beneficial in scenarios where you want increased financial protection. For auto insurance, higher coverage limits can safeguard against costly medical bills or property damage in a severe accident. Similarly, for home insurance, higher coverage limits can cover expensive repairs or replacement costs in case of a disaster.

Evaluating Personal Financial Risk Tolerance

When evaluating your financial risk tolerance, consider factors like your savings, income stability, and ability to cover unexpected expenses. It’s essential to strike a balance between affordable premiums and adequate coverage that aligns with your financial situation and comfort level.

Coverage for Uninsured and Underinsured Motorists

Uninsured and underinsured motorists coverage is an important component of full coverage car insurance in the United States. This type of coverage protects you if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover the damages.

Coverage for Uninsured Motorists

Uninsured motorist coverage provides protection if you are hit by a driver who does not have insurance. This coverage can help pay for medical expenses and property damage resulting from the accident. It is crucial in the United States, where a significant number of drivers are uninsured.

- According to the Insurance Information Institute, around 13% of drivers in the United States are uninsured.

- Most states require drivers to carry uninsured motorist coverage to protect themselves in case of an accident with an uninsured driver.

- Adding uninsured motorist coverage to your policy can increase the overall cost of your insurance premium, but it provides valuable protection.

Coverage for Underinsured Motorists

Underinsured motorist coverage comes into play when the at-fault driver’s insurance limits are insufficient to cover the full extent of your damages. This coverage helps bridge the gap between the other driver’s liability coverage and your actual expenses.

- Underinsured motorist coverage is essential when you are involved in an accident with a driver who lacks adequate insurance to cover your medical bills and repairs.

- It is essential to select appropriate coverage limits for underinsured motorists to ensure you are adequately protected in case of an accident.

Filing a Claim and Limitations

When filing a claim under uninsured or underinsured motorist coverage, you typically need to provide evidence of the other driver’s lack of insurance or insufficient coverage. There may be limitations or exclusions to this type of coverage, so it’s essential to review your policy carefully.

- Claims under uninsured/underinsured motorist coverage are typically handled similarly to other types of insurance claims, but specific requirements may vary.

- It’s crucial to understand your policy’s limitations and exclusions to ensure you receive the coverage you need in the event of an accident.

Selecting Coverage Limits

When choosing coverage limits for uninsured and underinsured motorists, consider your potential expenses in an accident scenario. Higher coverage limits may result in a slightly higher premium, but they offer greater protection in case of a severe accident.

Are you looking to compare car insurance rates in the United States? Look no further! Check out this helpful guide on car insurance rates comparison in the United States to find the best deal for your budget.

It’s important to strike a balance between affordability and adequate coverage when selecting limits for uninsured and underinsured motorists.

Optional Coverages to Enhance Full Coverage Policies

When it comes to enhancing your full coverage car insurance policy, there are several optional coverages that drivers can consider adding for extra protection and peace of mind.

Roadside Assistance Coverage

- Roadside assistance coverage provides help if your vehicle breaks down while you’re on the road. This can include services like towing, jump-starts, fuel delivery, and flat tire changes.

- Having roadside assistance coverage can save you time and money in emergency situations, ensuring you get back on the road quickly and safely.

- It’s especially useful for drivers who often travel long distances or have older vehicles that may be more prone to mechanical issues.

Rental Car Reimbursement Coverage

- Rental car reimbursement coverage helps pay for a rental vehicle if your car is in the shop for repairs after an accident.

- This coverage can be crucial in ensuring you have a temporary replacement vehicle to continue your daily activities while your car is being fixed.

- It provides convenience and peace of mind knowing that you won’t be left without transportation in case of an unexpected event.

Gap Insurance Coverage

- Gap insurance coverage protects you if your car is totaled in an accident and the payout from your insurance company is less than what you owe on your auto loan.

- This coverage bridges the “gap” between the actual cash value of your car and the amount you still owe, ensuring you’re not left with a hefty loan balance for a vehicle you no longer have.

- It’s especially beneficial for drivers with brand new vehicles or those who have financed their cars with a loan.

Claims Process for Full Coverage Car Insurance

When it comes to filing a claim with a full coverage car insurance policy, there are specific steps that policyholders need to follow to ensure a smooth and efficient process. Understanding the differences between filing a claim for comprehensive coverage and collision coverage can also help policyholders navigate the process effectively.

Here, we will delve into the details of the claims process for full coverage car insurance and provide tips for a hassle-free experience.

Filing a Claim for Comprehensive Coverage

- Contact your insurance provider as soon as possible after the incident to report the claim.

- An adjuster will assess the damage to your vehicle and determine the coverage provided under your comprehensive policy.

- You may need to provide documentation such as police reports, photos of the damage, and any other relevant information requested by the insurance company.

- Once the claim is approved, the insurance company will provide compensation for the repairs or replacement of your vehicle, minus your deductible.

Filing a Claim for Collision Coverage

- Notify your insurance company immediately following the accident to start the claims process.

- An adjuster will evaluate the damage to your vehicle and determine the coverage available under your collision policy.

- You may be required to obtain repair estimates and provide documentation to support your claim.

- After the claim is approved, the insurance company will cover the cost of repairs or replacement, minus your deductible.

Tips for a Smooth Claims Experience

- Keep detailed records of the incident, including photos, witness statements, and any relevant documents.

- Report the claim promptly to avoid any delays in the processing of your claim.

- Stay in communication with your insurance company throughout the claims process and provide any requested information promptly.

- Review your policy to understand your coverage limits, deductibles, and any exclusions that may apply to your claim.

Discounts and Savings Opportunities for Full Coverage

When it comes to full coverage car insurance, there are various discounts and savings opportunities that policyholders can take advantage of to reduce their insurance costs.

Common Discounts for Full Coverage Policies

- Multi-policy discount: Many insurance companies offer discounts to customers who bundle their auto insurance with other policies, such as homeowners or renters insurance.

- Safe driver discount: Drivers with a clean driving record and no recent accidents or traffic violations may be eligible for a discount on their full coverage premium.

- Good student discount: Students who maintain a certain GPA or are on the honor roll may qualify for a discount on their car insurance.

- Affiliation discounts: Some insurers offer discounts to members of certain organizations, alumni associations, or professional groups.

Bundling Policies for Savings

Combining multiple insurance policies with the same company can lead to significant savings on full coverage car insurance. By bundling auto, home, and other insurance policies, customers can often unlock discounts that would not be available if they purchased each policy separately.

Tips for Maximizing Discounts and Reducing Insurance Costs

- Shop around: Compare quotes from multiple insurance companies to find the best rates and discounts for your full coverage policy.

- Ask about available discounts: Inquire with your insurance agent about any discounts you may be eligible for based on your driving record, affiliations, or other factors.

- Consider raising your deductible: Opting for a higher deductible can lower your premium, but make sure you can afford the out-of-pocket costs in case of a claim.

- Maintain a good credit score: Some insurers use credit-based insurance scores to determine rates, so maintaining good credit can help you qualify for lower premiums.

Coverage for Special Circumstances

When it comes to car insurance, special circumstances such as teen drivers and senior drivers require unique considerations to ensure adequate coverage and protection. Both groups have specific needs and risk factors that insurance companies take into account when determining premiums and coverage options.

Coverage for Teen Drivers

Teen drivers are considered high-risk due to their lack of experience on the road, leading insurance companies to offer specific coverage options to address their unique needs. Essential coverage for teen drivers includes:

- Higher liability limits to protect against potential accidents

- Collision coverage to pay for damages to their vehicle

- Comprehensive coverage for non-collision-related incidents like theft or vandalism

Insurance Rates for Teen Drivers

Adding a teen driver to a policy often results in increased premiums due to the higher risk associated with inexperienced drivers. Insurance rates for teen drivers can be significantly higher compared to more experienced drivers, reflecting the increased likelihood of accidents and claims.

Coverage for Senior Drivers

Senior drivers may benefit from additional coverage options to address their specific needs and potential risks. Recommendations for senior drivers include:

- Medical payments coverage to cover medical expenses in case of injuries from an accident

- Roadside assistance coverage for added peace of mind while on the road

- Rental car reimbursement coverage to provide a temporary vehicle in case of repairs

Driving Habits and Risk Factors

Teen drivers are more prone to risky behaviors such as speeding and distracted driving, increasing the likelihood of accidents. On the other hand, senior drivers may face challenges such as decreased reaction times and vision impairments. Insurance companies evaluate these driving habits and risk factors to adjust premiums accordingly.

Premium Adjustments for Age-Related Risk Factors

Insurance companies take age-related risk factors into consideration when determining premiums for teen and senior drivers. Teens are typically charged higher premiums due to their inexperience and higher likelihood of accidents. In contrast, senior drivers may receive discounts for their years of driving experience and safe driving records.

Full Coverage Car Insurance for High-Risk Drivers

High-risk drivers are individuals who are more likely to get into accidents or file insurance claims due to factors such as a history of traffic violations, accidents, or poor credit scores. These drivers typically face higher insurance rates compared to low-risk drivers.

Impact of High-Risk Drivers on Insurance Rates

High-risk drivers are considered riskier to insure by insurance companies, leading to higher premiums. Factors such as a poor driving record, young age, or driving a high-performance vehicle can contribute to being classified as a high-risk driver.

- Insurance companies may offer full coverage options with higher premiums to high-risk drivers to provide comprehensive protection against potential risks.

- High-risk drivers may face limited coverage options or higher deductibles compared to low-risk drivers to offset the increased likelihood of filing claims.

Strategies for Finding Affordable Full Coverage Insurance as a High-Risk Driver

- Consider taking defensive driving courses to improve your driving skills and potentially qualify for insurance discounts.

- Shop around and compare quotes from multiple insurance providers to find the best rates for your high-risk driver profile.

- Look for insurance companies that specialize in providing coverage for high-risk drivers, as they may offer more competitive rates.

Comparison of Full Coverage and Minimum Coverage for High-Risk Drivers

High-risk drivers may benefit from full coverage insurance as it provides more extensive protection in case of accidents, theft, or other unforeseen events. While minimum coverage may be cheaper, it may not offer sufficient protection for high-risk drivers.

Improving Driving Record to Qualify for Lower Insurance Rates

- Follow traffic laws and regulations to avoid additional violations that could further increase your high-risk status.

- Maintain a clean driving record by driving safely and responsibly to demonstrate to insurance companies that you are a lower risk driver.

- Consider opting for usage-based insurance programs that track your driving behavior and offer discounts for safe driving habits.

Shopping Around and Taking Advantage of Discounts as a High-Risk Driver

- Request quotes from different insurance providers to compare rates and coverage options tailored to high-risk drivers.

- Ask about available discounts such as multi-policy, good student, or defensive driving course discounts to lower your insurance premiums.

- Consider bundling your auto insurance with other policies or insuring multiple vehicles with the same provider to qualify for additional savings.

Technology and Full Coverage Car Insurance

Technology plays a significant role in shaping the landscape of full coverage car insurance in the United States. From telematics to usage-based insurance, advancements in technology have revolutionized the insurance industry, offering both insurers and policyholders new opportunities and benefits.

Telematics and Full Coverage Insurance

Telematics technology, which involves the use of devices installed in vehicles to track driving behavior, has become increasingly popular in the insurance industry. Insurers can gather real-time data on factors such as speed, mileage, and braking patterns to assess risk more accurately.

This data allows insurers to offer personalized pricing based on individual driving habits, incentivizing safe driving practices.

Usage-Based Insurance Benefits

Usage-based insurance (UBI) is a type of coverage that utilizes telematics data to determine premiums. Policyholders can potentially save money by demonstrating safe driving behaviors, such as obeying speed limits and avoiding sudden stops. UBI encourages responsible driving and can lead to lower premiums for policyholders who exhibit safe habits on the road.

Technology and the Future of Full Coverage Insurance

Technology continues to shape the future of full coverage car insurance by promoting transparency, efficiency, and personalized offerings. Insurers are leveraging data analytics and artificial intelligence to streamline processes, enhance customer experiences, and develop innovative insurance products. The integration of technology into full coverage policies is expected to drive further advancements in the insurance industry, benefiting both insurers and policyholders alike.

Evaluating Insurance Providers for Full Coverage: Full Coverage Car Insurance In United States

When it comes to choosing an insurance provider for full coverage car insurance, there are several factors to consider to ensure you are getting the best coverage and service possible. From customer reviews to financial stability, evaluating insurance providers is crucial in making an informed decision.

Checklist for Evaluating Insurance Providers

- Check the financial stability of the insurance company by looking at ratings from agencies like A.M. Best, Standard & Poor’s, or Moody’s.

- Research the customer service reputation of the insurer by reading reviews and ratings on websites like J.D. Power or Consumer Reports.

- Compare quotes from multiple insurance providers to ensure you are getting competitive rates for the coverage you need.

- Check the coverage options offered by each insurer to make sure they meet your specific needs, including optional coverages and discounts.

- Look into the claims process of the insurance company to see how easy it is to file a claim and how quickly they respond to claims.

Customer Reviews and Satisfaction Ratings

Customer reviews and satisfaction ratings can provide valuable insights into the overall experience of policyholders with an insurance provider. Websites like J.D. Power, Consumer Reports, and the National Association of Insurance Commissioners (NAIC) can offer information on customer complaints, claims processing, and overall satisfaction levels with different insurers.

Importance of Financial Stability and Customer Service

Financial stability is crucial because you want to ensure the insurance company can pay out claims when needed. Customer service is also essential for a smooth experience when dealing with policy changes, claims, or inquiries.

It is important to choose an insurance provider with a strong financial rating and a reputation for excellent customer service to ensure you have a positive experience when dealing with them.

Trends and Developments in Full Coverage Car Insurance Industry

The full coverage car insurance industry is constantly evolving to adapt to changing circumstances and consumer needs. Let’s explore some of the current trends and developments shaping this sector.

Impact of Regulatory Changes on Full Coverage Policies

Regulatory changes at the state and federal levels can have a significant impact on full coverage car insurance policies. For example, new laws mandating minimum coverage requirements or introducing stricter regulations on insurers can lead to adjustments in premiums and coverage options for policyholders.

- States like California and New York have been at the forefront of implementing regulations aimed at protecting consumers and ensuring fair practices within the insurance industry.

- Changes in regulations related to autonomous vehicles and emerging technologies may also influence the way full coverage policies are structured and priced in the future.

Future Developments in Full Coverage Insurance

Looking ahead, advancements in technology, shifting consumer preferences, and evolving risk factors are expected to drive future developments in the full coverage car insurance industry.

- Integration of telematics and AI-driven solutions may lead to personalized pricing models and enhanced risk assessment capabilities for insurers.

- The rise of electric and autonomous vehicles could prompt insurers to offer specialized coverage options tailored to the unique needs of these emerging vehicle types.

- Climate change concerns and increasing frequency of natural disasters may necessitate the development of new coverage offerings to protect against environmental risks.

Last Point

Bidding adieu to our deep dive into full coverage car insurance in the United States, remember to drive safe, stay informed, and always compare your options to secure the best coverage for your needs.

FAQ Resource

Is full coverage car insurance mandatory in all states?

No, full coverage car insurance is not mandatory in all states, but it is highly recommended for comprehensive protection.

Does full coverage insurance cover theft of personal items from my car?

Unfortunately, no, full coverage insurance typically does not cover personal belongings stolen from your car. You may need additional coverage for this.

Can I adjust my deductible with full coverage insurance?

Yes, you can adjust your deductible with full coverage insurance to suit your financial needs and risk tolerance.