Cheap car insurance in united states is like finding a hidden treasure chest in a sea of expenses. Let’s dive into the world of affordable coverage and unlock the secrets to saving big on your car insurance!

Are you ready to discover the ins and outs of getting the best bang for your buck when it comes to car insurance? Let’s embark on this journey together!

Overview of Cheap Car Insurance in the United States

In the United States, cheap car insurance refers to affordable coverage that meets the legal requirements while offering financial protection in case of accidents or other incidents. It is essential for drivers to have car insurance to protect themselves and others on the road.

Average Cost of Car Insurance in Different States

The average cost of car insurance varies across different states in the U.S. Factors such as population density, crime rates, and weather conditions can impact insurance premiums. For example, states like Michigan and Louisiana have some of the highest average insurance rates, while states like Maine and Vermont have lower average costs.

Factors Influencing the Cost of Car Insurance

- Age: Younger drivers typically pay higher insurance premiums due to their lack of driving experience.

- Location: Urban areas with higher traffic congestion and crime rates may have higher insurance costs.

- Driving Record: Drivers with a history of accidents or traffic violations may face increased premiums.

- Type of Vehicle: The make, model, and age of the vehicle can affect insurance rates.

Comparison between Liability Insurance and Full Coverage Insurance

Basic liability insurance covers damages to others in an accident that you are responsible for, while full coverage insurance includes comprehensive and collision coverage for your vehicle as well. Full coverage insurance is more expensive but provides broader protection.

Understanding Deductibles in Car Insurance

Deductibles are the amount you pay out of pocket before your insurance coverage kicks in. Higher deductibles can lower your premiums, but you will have to pay more in case of a claim. It’s essential to choose a deductible that you can afford.

Hey there, world explorers! Are you ready to say “Hello world!” and dive into new adventures? Click here to discover the endless possibilities waiting for you: Hello world!

Importance of Shopping Around for Car Insurance

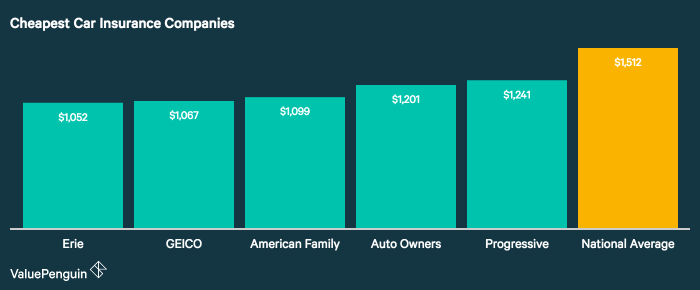

It’s crucial to compare quotes from different insurance companies to find the best coverage at the most affordable price. Each insurer has its own pricing model, so shopping around can help you save money and get the coverage you need.

Types of Coverage Available

When it comes to car insurance in the United States, there are several types of coverage options available to drivers. Each type of coverage offers different benefits and limitations depending on the individual’s needs and circumstances.

Liability Coverage

Liability coverage is mandatory in most states and helps cover costs associated with injuries or property damage that you are legally responsible for in an accident. This coverage does not protect your own vehicle but instead covers the other party’s expenses.

Collision Coverage

Collision coverage helps pay for repairs to your own vehicle in the event of a collision with another vehicle or object, regardless of fault. This coverage is beneficial for drivers with newer or more expensive vehicles.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damages not caused by a collision, such as theft, vandalism, or natural disasters. This coverage is ideal for those looking for additional protection beyond basic liability and collision coverage.

Uninsured/Underinsured Motorist Coverage

This type of coverage helps protect you if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover your expenses. Uninsured/underinsured motorist coverage can help cover medical bills, lost wages, and other costs.Overall, each type of coverage plays a crucial role in providing financial protection in different situations.

It’s essential to assess your needs and budget to determine which types of coverage are right for you.

Factors Affecting Car Insurance Rates

When it comes to determining car insurance rates, several factors come into play that can significantly impact how much you pay for coverage. Let’s explore these factors in more detail to understand how they influence your premiums.

Age, Gender, Driving History, Credit Score, and Location

- Your age and gender can affect your car insurance rates, as statistics show that younger drivers and males tend to have more accidents.

- A clean driving history with no accidents or traffic violations can help lower your insurance premiums, as it signifies a lower risk of future claims.

- Your credit score can also impact your car insurance rates, with better scores usually leading to lower premiums.

- Where you live plays a significant role in determining your car insurance rates, as areas with higher crime rates or traffic congestion may result in higher premiums.

Type of Vehicle, Mileage, and Usage

- The type of vehicle you drive, its make and model, safety features, and repair costs can all affect your insurance premiums.

- Higher mileage and more frequent use of your vehicle can lead to increased premiums, as it raises the risk of accidents and wear and tear.

Tips to Lower Car Insurance Rates

- Consider opting for a higher deductible to lower your premiums, but make sure you can afford the out-of-pocket costs in case of a claim.

- Bundle your car insurance with other policies like home or renters insurance to qualify for multi-policy discounts.

- Improve your credit score by paying bills on time and reducing debt to potentially lower your insurance rates.

Marital Status, Education Level, and Occupation

- Married individuals tend to receive lower car insurance rates compared to single drivers, as they are perceived as more responsible and less likely to engage in risky driving behaviors.

- Higher education levels and certain occupations can also lead to lower premiums, as they are associated with better decision-making and lower risk profiles.

Previous Insurance Coverage and Claims History

- Your previous insurance coverage and claims history can impact your current premiums, with a history of frequent claims leading to higher rates.

- Insurance companies assess these factors differently, so it’s essential to shop around and compare quotes to find the best rates based on your individual profile.

Overall Contribution to Premium Cost

| Factor | Contribution |

|---|---|

| Age and Gender | 20% |

| Driving History | 15% |

| Credit Score | 10% |

| Location | 15% |

| Type of Vehicle | 20% |

| Mileage and Usage | 10% |

| Marital Status, Education, Occupation | 5% |

| Previous Insurance and Claims History | 5% |

State-Specific Considerations: Cheap Car Insurance In United States

When it comes to car insurance in the United States, each state has its own set of regulations and requirements that can significantly impact both the cost and coverage of policies. Understanding these state-specific considerations is crucial for drivers to ensure they have the appropriate coverage in place.

Average Car Insurance Rates Across Different States

In the United States, car insurance rates can vary widely from state to state. Factors such as population density, traffic congestion, weather conditions, and state regulations all play a role in determining the average cost of car insurance. For example, states with high rates of uninsured drivers may have higher premiums to account for the increased risk.

Hey there! Are you ready to say “Hello world!” to the exciting world of auto insurance? If not, you better click Hello world! and discover a whole new universe of coverage options and savings waiting just for you!

No-Fault Insurance States vs. At-Fault Insurance States

States in the U.S. are classified as either no-fault or at-fault insurance states. In no-fault states, each driver’s insurance covers their own medical expenses regardless of who is at fault in an accident. On the other hand, at-fault states require the at-fault driver to cover the medical expenses of the other driver.

This distinction can impact policyholders in terms of premiums and coverage options.

Minimum Liability Coverage Requirements

Minimum liability coverage requirements vary from state to state, with some states requiring higher coverage limits than others. These requirements influence insurance premiums, as drivers in states with higher minimum coverage limits may pay more for their policies. It’s important for drivers to understand their state’s minimum requirements to ensure they are adequately protected.

State-Specific Factors Influencing Car Insurance Rates

State-specific factors such as weather conditions, population density, and traffic congestion can all impact car insurance rates. For example, states prone to severe weather may have higher premiums to account for the increased risk of accidents. Similarly, densely populated states with high traffic congestion may also have higher insurance rates.

Uninsured or Underinsured Motorist Coverage

The presence of uninsured or underinsured motorist coverage in car insurance policies is influenced by state regulations. Some states require drivers to carry this coverage, while others do not. This coverage protects policyholders in the event they are in an accident with a driver who does not have insurance or enough coverage to pay for damages.

Understanding state regulations regarding this coverage is essential for drivers to ensure they are adequately protected.

Tips for Finding Affordable Car Insurance

When it comes to finding affordable car insurance, there are several strategies you can use to secure the best rates and coverage for your needs. From comparing quotes to leveraging discounts and negotiating with insurance companies, here are some tips to help you find cheap car insurance:

Compare Quotes from Multiple Providers

One of the most effective ways to find affordable car insurance is to compare quotes from multiple providers. By shopping around and obtaining quotes from different insurance companies, you can identify the best rates and coverage options available to you.

Make sure to consider not only the premium cost but also the coverage limits and deductibles when comparing quotes.

Bundle Policies for Discounts

Another way to save on car insurance is to bundle your policies. Many insurance companies offer discounts when you purchase multiple policies from them, such as combining your car insurance with your homeowner’s or renter’s insurance. Bundling policies can lead to significant savings on your overall insurance costs.

Take Advantage of Discounts

Insurance companies offer a variety of discounts that can help lower your premiums. These discounts may include safe driver discounts, discounts for having anti-theft devices or safety features in your car, or discounts for completing a defensive driving course. Be sure to inquire about all available discounts when shopping for car insurance.

Maintain a Good Credit Score

Having a good credit score can also help you secure lower insurance rates. Insurance companies often use credit-based insurance scores to determine premiums, with a higher credit score typically resulting in lower rates. To improve your credit score, make sure to pay your bills on time, keep your credit card balances low, and monitor your credit report for any errors.

Negotiate with Insurance Companies, Cheap car insurance in united states

Don’t be afraid to negotiate with insurance companies to lower your premiums. If you have a clean driving record or can demonstrate your low-risk profile, you may be able to negotiate a lower rate with your insurer. Additionally, consider increasing your deductibles or adjusting your coverage limits to find a more affordable insurance option that still meets your needs.

Understanding Deductibles and Coverage Limits

When it comes to car insurance, understanding deductibles and coverage limits is crucial for making informed decisions that can impact your insurance premiums and level of protection.Explain the concept of deductibles and how choosing a higher or lower deductible can impact insurance premiums.Deductibles refer to the amount of money you are required to pay out of pocket before your insurance coverage kicks in to cover the rest of the expenses in the event of a claim.

Choosing a higher deductible typically results in lower monthly premiums, but you will have to pay more upfront in case of an accident or damage. On the other hand, selecting a lower deductible means higher monthly premiums but less out-of-pocket expenses at the time of a claim.Discuss the importance of understanding coverage limits and selecting appropriate coverage levels based on individual needs.Coverage limits Artikel the maximum amount your insurance company will pay out for a covered claim.

It is essential to assess your individual needs and risks to determine the appropriate coverage levels. A comprehensive review of your assets, driving habits, and budget can help you decide on the right amount of coverage to protect yourself adequately.Provide examples of how different deductible and coverage limit choices can affect insurance costs.For example, if you choose a $500 deductible and a coverage limit of $50,000 for property damage, your premiums may be higher than if you opt for a $1,000 deductible and a coverage limit of $25,000.

By adjusting these factors, you can customize your policy to meet your financial situation and risk tolerance while balancing the cost of insurance.

Impact of Driving Record on Insurance Rates

Maintaining a clean driving record is crucial when it comes to determining your car insurance rates. Insurance companies often use your driving history as a key factor in assessing the level of risk you pose as a driver. Let’s explore how different aspects of your driving record can impact your insurance premiums and what you can do to potentially lower them.

Driving Violations

- Speeding Tickets: Speeding tickets can lead to an increase in insurance rates, as they indicate a higher risk of accidents.

- Reckless Driving: Being charged with reckless driving can significantly raise your insurance premiums due to the severe nature of this violation.

- DUI/DWI: Driving under the influence or driving while intoxicated can have a major impact on insurance rates, often resulting in substantial increases or even policy cancellation.

Accidents and Claims History

- At-Fault Accidents: Being deemed at fault in an accident can cause a significant spike in insurance rates, as it suggests a higher likelihood of future claims.

- Claims History: Making multiple claims within a short period can also lead to higher insurance premiums, as it indicates a pattern of increased risk.

Improving Your Driving Record

- Defensive Driving Courses: Completing a defensive driving course can sometimes result in a discount from your insurance provider.

- Traffic School: Attending traffic school for minor violations may help prevent points from appearing on your driving record.

- Safe Driving Practices: Consistently practicing safe driving habits can gradually improve your record and potentially lead to lower insurance rates over time.

Discounts and Savings Opportunities

When it comes to saving money on car insurance, taking advantage of discounts can make a significant impact on your overall costs. Insurance companies offer various discounts to policyholders based on factors like driving history, vehicle safety features, and more.

By understanding the different types of discounts available and how to qualify for them, you can potentially reduce your insurance expenses.

Safe Driver Discounts

- Safe driver discounts are often offered to policyholders who maintain a clean driving record without any accidents or traffic violations.

- Drivers with a history of safe driving are considered lower risk by insurance companies, leading to lower premiums.

- To qualify for a safe driver discount, you typically need to have a certain number of years without any at-fault accidents or moving violations.

- Some insurance companies may also require you to complete a defensive driving course to be eligible for this discount.

Multi-Policy Discounts

- Multi-policy discounts are available to policyholders who bundle multiple insurance policies with the same company, such as auto and home insurance.

- By bundling policies, you can often receive a discount on each policy, resulting in overall savings on your insurance premiums.

- To qualify for a multi-policy discount, you typically need to have at least two insurance policies with the same company.

- Combining your policies can not only save you money but also simplify your insurance management by dealing with a single insurer for multiple needs.

Vehicle Safety Features Discounts

- Insurance companies may offer discounts for vehicles equipped with safety features such as anti-lock brakes, airbags, and anti-theft devices.

- These safety features reduce the risk of accidents and theft, making your vehicle less costly to insure.

- To qualify for this discount, you may need to provide documentation or proof of the safety features installed in your vehicle.

- Investing in safety features not only protects you on the road but can also lead to savings on your insurance premiums.

Student Discounts

- Some insurance companies offer discounts to students who maintain good grades in school or college.

- Students with high academic performance are often considered responsible and less likely to engage in risky driving behaviors.

- To qualify for a student discount, you may need to provide your academic transcripts or report cards as proof of your good grades.

- Taking advantage of student discounts can help young drivers reduce their insurance costs while rewarding academic excellence.

Online Tools and Resources for Comparing Rates

When looking for affordable car insurance, utilizing online tools and resources can save you time and money. These platforms allow you to compare rates from different providers, ensuring you find the best deal to suit your needs.

Reputable Websites for Comparing Rates

- Insurance.com

- The Zebra

- Compare.com

Benefits of Using Online Resources

- Convenience of comparing multiple quotes in one place

- Potential for significant cost savings

- Access to a wide range of insurance providers

Tips for Effectively Using Online Tools

- Ensure you provide accurate information to receive precise quotes

- Use filters to tailor results based on your specific coverage needs

- Review customer reviews and ratings to assess the reliability of insurance providers

Utilizing Filters on Comparison Websites

By adjusting filters for factors such as coverage limits and deductibles, you can customize your search results to find the most suitable car insurance options.

Importance of Reviewing Customer Reviews

- Customer feedback can provide insights into the quality of service offered by insurance providers

- Consider both positive and negative reviews to make an informed decision

Step-by-Step Guide for Inputting Information

- Enter your zip code to ensure accurate location-based quotes

- Provide details about your vehicle, driving history, and coverage preferences

- Review the information before submitting to avoid errors in the quoting process

Checking for Discounts and Special Offers

Be sure to look for discounts or promotions that may not be prominently displayed on comparison websites. These deals can provide additional savings on your car insurance premiums.

Considerations for High-Risk Drivers

When it comes to car insurance, high-risk drivers face unique challenges due to their driving history or other factors that classify them as higher risk individuals. This classification can significantly impact the rates they are offered by insurance companies, making it essential for them to explore alternative options for affordable coverage.

Defining High-Risk Drivers

High-risk drivers are individuals who have a history of traffic violations, accidents, DUI convictions, or other factors that suggest a higher likelihood of filing insurance claims. This classification can lead to higher insurance premiums and limited options for coverage.

- Multiple at-fault accidents

- Driving under the influence (DUI) convictions

- Speeding tickets or other traffic violations

- Poor credit history

Options for High-Risk Drivers

For high-risk drivers, there are specialized insurance companies that focus on providing coverage tailored to their needs. These companies may offer more flexible payment options, higher deductibles, or other accommodations to make insurance more accessible.

Improving Driving Record

High-risk drivers can take steps to improve their driving record, such as completing defensive driving courses or maintaining a clean record for a specified period. By demonstrating responsible driving behavior, they can potentially lower their insurance premiums over time.

Specialized Insurance Companies

Insurance companies that specialize in coverage for high-risk drivers may have varying rates and coverage options. It’s essential for high-risk drivers to compare quotes from multiple providers to find the most affordable and suitable policy for their needs.

| Factors | Impact on Insurance Rates |

|---|---|

| At-fault accidents | Significantly higher rates |

| DUI convictions | Highly increased premiums |

| Traffic violations | Elevated insurance costs |

| Poor credit history | Potential surcharges |

Impact of Vehicle Type on Insurance Premiums

When it comes to car insurance premiums, the type of vehicle you drive plays a significant role in determining the cost of coverage. Insurance companies take into account various factors related to your vehicle, such as the make, model, age, and safety features, to assess the level of risk associated with insuring it.

Comparison of Insurance Costs for Different Vehicle Types

- Sedans: Sedans are typically considered low-risk vehicles due to their size and safety features, resulting in lower insurance premiums.

- SUVs: SUVs are often more expensive to insure compared to sedans due to their higher repair costs and increased likelihood of damage in accidents.

- Trucks: Trucks can vary in insurance costs depending on factors such as size, usage, and safety features, with some models being more affordable to insure than others.

- Sports Cars: Sports cars are considered high-risk vehicles due to their powerful engines and increased likelihood of speeding, resulting in higher insurance rates.

Specific Vehicle Characteristics and Insurance Rates

Advanced safety features such as anti-theft systems, airbags, and backup cameras can lead to lower insurance premiums due to reduced risk of accidents and theft.

Older vehicles may have higher insurance rates due to the increased likelihood of mechanical failures and costly repairs.

Luxury vehicles often come with higher insurance costs due to the expensive replacement parts and repair expenses.

Additional Coverage Considerations

When it comes to car insurance, there are optional coverages available that can provide added protection and peace of mind for drivers. These additional coverages can enhance a basic car insurance policy and offer benefits in specific situations.

Roadside Assistance

Roadside assistance coverage can be a valuable addition to your policy, especially if you frequently travel long distances or have an older vehicle prone to breakdowns. This coverage typically includes services like towing, tire changes, fuel delivery, and lockout assistance.

Rental Car Reimbursement

Rental car reimbursement coverage can be beneficial if your vehicle is in the shop for repairs after an accident. This coverage helps cover the cost of a rental car while your car is being repaired, ensuring you have transportation in the meantime.

Gap Insurance

Gap insurance is important for drivers who have a loan or lease on their vehicle. In the event of a total loss, such as theft or a severe accident, gap insurance covers the difference between the actual cash value of your car and the amount you owe on your loan or lease.

Cost-Benefit Analysis

When considering adding optional coverages to your car insurance policy, it’s essential to weigh the cost against the benefits they offer. While these coverages can increase your premium, they can also provide valuable protection and financial assistance in specific situations.

Table of Optional Coverages

| Coverage Option | Cost | Coverage Details |

|---|---|---|

| Roadside Assistance | $50 per year | Towing, tire changes, fuel delivery, lockout assistance |

| Rental Car Reimbursement | $20 per month | Coverage for rental car costs during repairs |

| Gap Insurance | $100 one-time fee | Covers the difference between car value and loan amount |

Filing a claim for optional coverages like roadside assistance typically involves contacting your insurance provider’s designated service provider, who will assist you with the necessary services.

Choosing the Right Coverage

To determine which additional coverage options are most suitable for your needs, consider factors such as your driving habits, the age of your vehicle, and your financial situation. Evaluate the potential benefits of each coverage option based on your individual circumstances to make an informed decision.

Customer Satisfaction and Reviews

When it comes to choosing a car insurance company in the United States, customer satisfaction and reviews play a crucial role. It’s essential to consider the experiences of other policyholders to make an informed decision about which insurer to trust with your coverage.

Exploring Customer Satisfaction Ratings

- Customer satisfaction ratings can provide valuable insights into the overall experience customers have had with a particular insurance company.

- Look for ratings from reputable sources like J.D. Power, Consumer Reports, or the National Association of Insurance Commissioners (NAIC) to gauge customer satisfaction levels.

- Consider factors such as claims processing, customer service, pricing, and overall satisfaction when reviewing ratings.

Importance of Customer Feedback

Customer feedback can give you a glimpse into the day-to-day interactions and experiences of policyholders with a specific insurance provider.

- Positive reviews can indicate reliable customer service, quick claims processing, and fair pricing.

- Negative reviews may highlight issues like denied claims, poor communication, or difficulty reaching customer support.

Tips for Evaluating Customer Reviews

- Look for patterns in reviews rather than focusing on individual comments to get a more accurate representation of the company’s performance.

- Consider the volume of reviews – a company with a large number of positive reviews is likely more reliable than one with only a few reviews.

- Check if the insurance company responds to reviews, addressing any concerns or issues raised by customers.

Epilogue

From understanding coverage options to maximizing discounts, we’ve covered it all when it comes to cheap car insurance in the United States. Remember, saving money on insurance doesn’t have to be complicated – it just takes a little know-how and a willingness to explore your options!

FAQ Compilation

What factors can impact the cost of car insurance in the United States?

Factors such as age, location, driving record, and type of vehicle can all influence the cost of car insurance premiums in the United States.

How can I find the most affordable car insurance rates?

To find affordable car insurance rates, consider comparing quotes from multiple providers, maintaining a good credit score, and exploring available discounts.

What are some common discounts offered by car insurance companies?

Car insurance companies often offer discounts for safe drivers, multi-policy holders, and students. Taking advantage of these discounts can lead to significant savings on insurance premiums.

How does my driving record impact my car insurance rates?

Your driving record, including violations, accidents, and claims history, can directly affect your car insurance rates. Maintaining a clean driving record can help lower insurance premiums.

What are some state-specific considerations to keep in mind when shopping for car insurance?

Each state may have unique regulations and requirements for car insurance, impacting factors such as coverage options and minimum liability requirements. It’s important to be aware of these state-specific considerations when purchasing car insurance.