Best car insurance in united states – buckle up for a wild ride through the world of car insurance in the U.S. From coverage types to top companies, we’ve got you covered!

Overview of Car Insurance in the United States

Car insurance is a crucial aspect of owning and driving a vehicle in the United States. It provides financial protection in case of accidents, theft, or other damages that may occur while operating a vehicle on the road. Without car insurance, individuals may face significant financial burdens in the event of an unforeseen incident.

Types of Coverage Available in the U.S.

- Liability Coverage: This type of coverage helps pay for the costs associated with injuries and property damage that you are legally responsible for in an accident.

- Collision Coverage: Collision coverage helps pay for the repair or replacement of your vehicle if it is damaged in an accident.

- Comprehensive Coverage: Comprehensive coverage provides protection for non-collision incidents, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage helps protect you if you are involved in an accident with a driver who does not have insurance or lacks sufficient coverage.

Legal Requirements for Car Insurance in Different States

In the United States, each state has its own set of laws and requirements regarding car insurance. While the specifics may vary, most states typically require drivers to carry a minimum amount of liability coverage. Some states also mandate additional types of coverage, such as personal injury protection or uninsured motorist coverage.

It is essential for drivers to familiarize themselves with the specific insurance requirements in their state to ensure compliance with the law and adequate protection in case of an accident.

Factors to Consider When Choosing the Best Car Insurance

When selecting the best car insurance policy, there are several key factors to keep in mind that can impact your coverage and premiums. Understanding these factors can help you make an informed decision that suits your needs and budget.

Factors Influencing Car Insurance Premiums

- Driver’s Age: Younger drivers typically pay higher premiums due to their lack of driving experience.

- Location: The area where you live can affect your rates, with urban areas often having higher premiums.

- Type of Vehicle: The make and model of your car can impact insurance costs, with expensive or high-performance vehicles costing more to insure.

- Driving History: Your past driving record, including accidents, tickets, and claims, can influence your insurance rates.

Comparison of Coverage Options

- Liability Coverage: Protects you financially if you are at fault in an accident and covers damages to others involved.

- Collision Coverage: Covers damages to your own car in an accident, regardless of fault.

- Comprehensive Coverage: Protects against non-collision incidents like theft, vandalism, or natural disasters.

Impact of Driving Record on Insurance Rates

- Accidents: Being involved in accidents can lead to higher premiums as it indicates higher risk.

- Tickets: Traffic violations can also result in increased insurance costs.

- Claims History: Making frequent claims may cause your rates to go up as it suggests a higher likelihood of future claims.

Types of Discounts Available

- Safe Driver Discounts: Rewards for maintaining a clean driving record without accidents or violations.

- Multi-Policy Discounts: Savings for bundling car insurance with other policies like home insurance.

- Good Student Discounts: Lower rates for students who excel academically.

Filing a Claim and Reviewing Policy Details

- Process of Filing a Claim: Contact your insurance company immediately after an accident to start the claims process.

- Importance of Reviewing Policy Details: Make sure you understand your coverage limits, deductibles, and exclusions to avoid surprises when filing a claim.

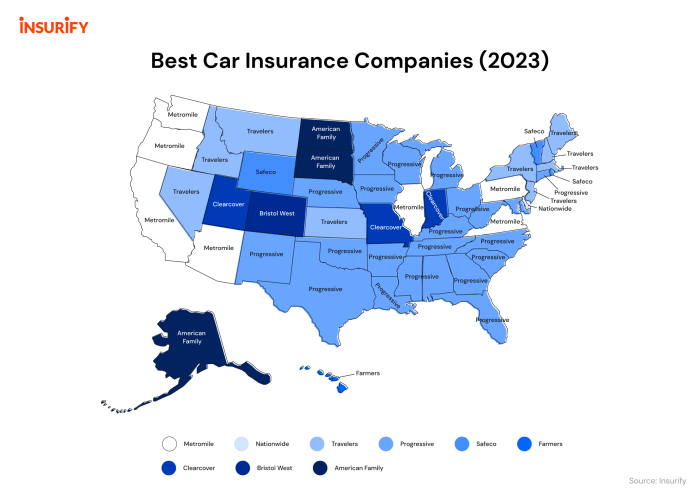

Top Car Insurance Companies in the United States

When it comes to choosing the best car insurance provider in the United States, there are several top companies that stand out for their financial strength, customer satisfaction ratings, and unique features. Let’s take a closer look at some of the leading car insurance companies in the country.

State Farm

State Farm is one of the largest car insurance providers in the United States, known for its excellent customer service and wide range of coverage options. They offer policies for liability, comprehensive, collision, and personal injury protection. State Farm also provides discounts for safe drivers, good students, and bundling policies.

GEICO

GEICO is another popular choice for car insurance, with competitive rates and a variety of discounts available to policyholders. They have a user-friendly online platform for policy management and claims tracking. GEICO offers coverage options such as liability, comprehensive, collision, and personal injury protection.

Progressive

Progressive is well-known for its innovative approach to car insurance, offering unique features like Snapshot, which tracks your driving habits to potentially lower your premium. They provide coverage for liability, comprehensive, collision, and personal injury protection. Progressive also offers discounts for safe drivers and bundling policies.

Allstate

Allstate is a trusted name in the insurance industry, offering a range of coverage options including liability, comprehensive, collision, and personal injury protection. They provide discounts for safe drivers, good students, and bundling policies. Allstate has a user-friendly mobile app for policy management and claims filing.

USAA

USAA is known for its exceptional customer service and coverage options tailored to military members and their families. They offer liability, comprehensive, collision, and personal injury protection. USAA provides discounts for safe drivers, bundling policies, and good student discounts.

Comparison of Average Annual Premiums

| Insurance Company | Minimum Coverage | Standard Coverage | Full Coverage |

|---|---|---|---|

| State Farm | $500 | $1,000 | $1,500 |

| GEICO | $450 | $900 | $1,400 |

| Progressive | $480 | $950 | $1,450 |

| Allstate | $520 | $1,050 | $1,600 |

| USAA | $400 | $850 | $1,300 |

Online Tools and Mobile Apps

When it comes to managing your car insurance policy, many companies offer online tools and mobile apps for convenience. State Farm, GEICO, Progressive, Allstate, and USAA all provide platforms for policy management, claims tracking, and customer support. These tools make it easy to access your policy information, file a claim, and get assistance whenever you need it.

Looking for cheap car insurance in the United States ? Well, you’re in luck! With so many options available, it can be overwhelming to find the best deal. But don’t worry, we’ve got you covered with tips and tricks to save money on your car insurance while still getting the coverage you need.

Say goodbye to expensive premiums and hello to affordable rates!

Cost of Car Insurance Across Different States

When it comes to car insurance, the cost can vary significantly depending on the state you reside in. Several factors play a role in determining the insurance premiums, such as population density, crime rates, and weather conditions. Let’s delve into the average cost of car insurance in various states and explore the reasons behind the differences.

States with the Highest and Lowest Insurance Premiums

- California: California is known for having some of the highest car insurance rates in the country. The state’s large population, high number of vehicles on the road, and urban areas contribute to the elevated premiums.

- North Dakota: On the other end of the spectrum, North Dakota is among the states with the lowest insurance premiums. The state’s rural nature and lower population density play a role in keeping insurance costs down.

Types of Coverage Offered in Different States

- Minimum coverage: Some states require only minimum liability coverage, which can result in lower premiums.

- No-fault insurance: States with no-fault insurance systems may have higher premiums due to the additional coverage provided.

Top 5 States with the Most Expensive and Least Expensive Insurance

| Top 5 States with Most Expensive Insurance | Top 5 States with Least Expensive Insurance |

|---|---|

| New York | North Dakota |

| Michigan | Ohio |

| Louisiana | Indiana |

| Florida | Wisconsin |

| California | Tennessee |

Tips for Saving Money on Car Insurance

When it comes to car insurance, there are several ways you can save money on premiums without compromising on coverage. Here are some practical tips to help you lower your car insurance costs:

Benefits of Bundling Insurance Policies

One effective way to save money on car insurance is by bundling your policies. This means purchasing multiple insurance policies, such as auto and home insurance, from the same provider. By bundling your policies, insurance companies often offer discounts, resulting in overall savings on your premiums.

Maintaining a Good Credit Score for Lower Rates

Another factor that can help you save money on car insurance is maintaining a good credit score. Insurance companies often use credit scores as a factor in determining your insurance premium rates. Individuals with higher credit scores are generally viewed as less risky to insure, leading to lower rates compared to those with poor credit scores.

Understanding Car Insurance Claims Process: Best Car Insurance In United States

When it comes to car insurance, understanding the claims process is crucial for every driver. Knowing the steps involved, common reasons for claim denials, and how to ensure a smooth process can make a significant difference when the unexpected happens.

Steps in Filing a Car Insurance Claim

- Contact your insurance company immediately after the incident to report the claim.

- Provide all necessary information, including details of the accident, photos of damages, and any relevant documents.

- Work with the insurance adjuster to assess the damages and determine coverage.

- Get an estimate for repairs from a trusted mechanic or body shop.

- Review the settlement offered by the insurance company and negotiate if necessary.

Common Reasons for Car Insurance Claim Denials

- Failure to report the claim promptly.

- Policy exclusions that do not cover the specific incident.

- Insufficient evidence or documentation to support the claim.

- Discrepancies in the information provided or suspected fraud.

- Unpaid premiums or lapsed coverage at the time of the incident.

Tips for Ensuring a Smooth Claims Process

- Keep detailed records of the incident, including photos, witness statements, and police reports.

- Communicate clearly and promptly with your insurance company and adjuster.

- Follow up on the progress of your claim and ask questions if needed.

- Be honest and transparent in providing information to avoid claim denials.

Necessary Information to Gather Before Filing a Car Insurance Claim, Best car insurance in united states

- Date, time, and location of the incident.

- Details of the other party involved, including insurance information.

- Photos of the damages to your vehicle and any other vehicles or property.

- Contact information for witnesses and the police report number.

Importance of Documenting All Relevant Details and Damages

It is essential to document all relevant details and damages when filing a car insurance claim to ensure that you receive fair compensation for the losses incurred. Providing clear evidence can expedite the claims process and help avoid disputes with the insurance company.

Role of the Insurance Adjuster and Effective Communication

Insurance adjusters play a crucial role in assessing damages and determining coverage for car insurance claims. Effective communication with the adjuster can help clarify any questions, provide additional information, and ensure a fair settlement for your claim.

Situations Not Covered by Car Insurance

- Intentional damage or illegal activities.

- Racing or reckless driving.

- Use of the vehicle for commercial purposes without proper coverage.

- Uninsured or underinsured motorists in some states.

- Wear and tear or mechanical breakdowns.

Importance of Customer Service in Car Insurance

Good customer service is crucial when it comes to car insurance. It can make the process of purchasing a policy, filing a claim, or resolving any issues much smoother and less stressful for the policyholder. Companies that prioritize excellent customer service tend to have higher customer satisfaction rates and retention.

Significance of Good Customer Service

Having a reliable and responsive customer service team can make a significant difference for policyholders. Whether it’s answering questions about coverage, helping with claims, or providing assistance in emergencies, good customer service can build trust and loyalty with customers.

Examples of Companies Known for Excellent Customer Service

- Amica Mutual

- USAA

- State Farm

- Geico

These companies are often praised for their personalized service, quick response times, and overall customer satisfaction.

How Customer Reviews Can Help in Choosing the Right Insurance Company

Reading customer reviews and testimonials can give you insight into the level of customer service provided by different insurance companies. Look for feedback on how quickly claims were processed, how helpful representatives were, and overall customer experiences to help you make an informed decision.

Factors Affecting Car Insurance Rates

Car insurance rates are influenced by various factors that can significantly impact the premiums a driver pays. Understanding these factors can help individuals make informed decisions when selecting car insurance coverage.

Driver’s Age, Gender, and Marital Status

- Younger drivers, especially teenagers, tend to pay higher premiums due to their lack of driving experience and higher risk of accidents.

- Gender can also play a role, with young male drivers typically facing higher rates compared to female drivers of the same age.

- Married individuals often receive lower insurance rates as they are perceived to be more responsible and less likely to engage in risky driving behaviors.

Driver’s Location and Driving Record

- Insurance rates can vary based on the location where the driver resides, with urban areas generally having higher rates due to increased traffic and crime rates.

- A clean driving record with no accidents or traffic violations can lead to lower insurance premiums, as it reflects a lower risk of claims.

Frequency of Car Usage

- Drivers who use their cars frequently are more likely to be involved in accidents, resulting in higher insurance costs.

- Reducing the annual mileage can help lower insurance premiums, as it decreases the risk of accidents.

Vehicle’s Value, Make, and Model

- The value, make, and model of the vehicle can impact insurance rates, with luxury cars and sports cars typically carrying higher premiums due to their higher repair costs.

- Newer vehicles with advanced safety features may qualify for discounts on insurance premiums.

Safety Features and Coverage Limits

- Installing safety features such as anti-theft devices and airbags can reduce the risk of theft or injuries, leading to lower insurance rates.

- The choice of coverage limits and types, such as comprehensive or collision coverage, can affect insurance premiums based on the level of protection selected.

Credit Score and Financial History

- A driver’s credit score and financial history can impact insurance rates, as individuals with poor credit may be considered higher risk and charged higher premiums.

Deductibles

- Deductibles represent the amount a driver must pay out of pocket before insurance coverage kicks in.

- Choosing a higher deductible can lower monthly insurance costs, but it also means paying more in the event of a claim.

Specialized Car Insurance Coverage Options

When it comes to car insurance, there are specialized coverage options that cater to specific needs and situations. These options can provide additional protection and peace of mind for drivers in unique circumstances.

Roadside Assistance Coverage

- Roadside assistance coverage is a valuable addition to a car insurance policy as it provides services such as towing, fuel delivery, flat tire changes, and lockout assistance.

- Having roadside assistance coverage can help drivers in emergencies and breakdowns, ensuring they get the necessary help quickly and efficiently.

Classic Car Insurance

- Classic car insurance is designed specifically for vintage or collectible vehicles and offers coverage that differs from standard auto insurance.

- With classic car insurance, vehicles are typically covered based on an agreed-upon value, taking into account the car’s rarity, condition, and value as a collector’s item.

Choosing Coverage for Antique or Collector Cars

- When selecting coverage for antique or collector cars, it’s essential to consider factors such as the car’s value, rarity, and how it will be used to determine the right level of coverage.

- Working with an insurance provider experienced in insuring classic cars can help ensure adequate protection for these valuable assets.

Custom Equipment Coverage for Modified Vehicles

- Adding custom equipment coverage to a car insurance policy is crucial for owners of modified vehicles to protect aftermarket upgrades, such as stereo systems, custom paint jobs, or performance enhancements.

- Custom equipment coverage ensures that these additions are included in the coverage limits and can be repaired or replaced in case of damage or theft.

Rental Car Insurance Options

- When traveling domestically, rental car insurance options may include coverage through your existing car insurance policy, credit card benefits, or purchasing coverage directly from the rental car company.

- For international travel, it’s important to check with your insurance provider regarding coverage options as they may differ from domestic policies.

Uninsured and Underinsured Motorist Coverage

- Uninsured and underinsured motorist coverage is essential in a car insurance policy to protect against accidents involving drivers who do not have insurance or sufficient coverage.

- This coverage ensures that you are financially protected in case you are involved in an accident with an uninsured or underinsured driver.

Telematics and Usage-Based Insurance

Telematics devices are tools that collect data on driving behavior by tracking various aspects of a driver’s actions behind the wheel. This data is then used by insurance companies to assess risk levels and determine insurance premiums. Usage-based insurance, which utilizes telematics technology, offers a more personalized approach to pricing and coverage based on individual driving habits.

Are you looking for cheap car insurance in the United States ? Well, you’re in luck! With so many options available, it’s important to compare quotes to find the best deal. Don’t break the bank on your car insurance when you can find affordable rates with just a few clicks!

Data Collection and Usage

Telematics devices collect data such as speed, acceleration, braking patterns, mileage, and even time of day when the vehicle is in use. This information provides insurers with a comprehensive overview of a driver’s behavior on the road, allowing for a more accurate risk assessment.

Benefits of Usage-Based Insurance

Potential cost savings

Drivers with safe driving habits can benefit from lower premiums.

Personalized premiums

Insurance rates are tailored to individual driving behaviors.

Improved driving habits

By receiving feedback on their driving, policyholders may become safer drivers.

Comparison with Traditional Insurance

Traditional insurance policies rely on general demographic information and historical data to set premiums, while telematics-based insurance assesses risk in real-time. This can lead to fairer pricing, as premiums are based on actual driving habits rather than statistical averages.

Real-Life Scenarios

In real-life scenarios, telematics data has been used to adjust premiums based on actual driving behavior. For example, a driver who consistently speeds and brakes harshly may see an increase in their premium, while a driver who practices safe habits could enjoy discounts.

Feature Comparison

| Features | Traditional Insurance | Usage-Based Insurance |

|---|---|---|

| Coverage Options | Standard packages | Customized based on driving behavior |

| Premium Calculation | Based on historical data and demographics | Based on real-time driving habits |

| Policy Customization | Limited customization options | Highly personalized policies |

Impact of COVID-19 on Car Insurance Industry

The COVID-19 pandemic has had a significant impact on the car insurance industry, affecting everything from rates to claims processes.

Changes in Driving Habits and Insurance Claims

During the pandemic, many people have been working from home, leading to a decrease in daily commuting and overall driving. This reduction in driving has resulted in fewer accidents and claims being made to insurance companies. As a result, some insurance companies have seen a decrease in their claim payouts and have adjusted their rates accordingly to reflect the reduced risk.

Insurance Companies’ Adaptations During the Pandemic

Insurance companies have had to adapt their policies to meet the changing needs of their customers during the pandemic. Many companies have offered flexible payment options and extensions on policy deadlines to accommodate those facing financial difficulties. Additionally, some insurers have provided refunds or discounts to policyholders due to the decrease in driving and subsequent decrease in claims.

Impact on Car Insurance Rates

The decrease in driving and claims during the pandemic has led to some insurance companies reducing their rates to reflect the lower risk of accidents. However, not all insurers have lowered their rates, as other factors such as increased costs for medical care and auto repairs may have offset the decrease in claims.

It is essential for consumers to shop around and compare rates to ensure they are getting the best deal during these uncertain times.

Legal Considerations in Car Insurance

Car insurance laws vary by state, so it’s crucial to understand the legal aspects of your coverage to ensure you are adequately protected in case of an accident.

Role of Uninsured and Underinsured Motorist Coverage

Uninsured and underinsured motorist coverage protects you if you are involved in an accident with a driver who does not have insurance or sufficient coverage to pay for damages.

Importance of Understanding State-Specific Insurance Laws

Each state has its own laws regarding car insurance requirements, so it’s essential to know the minimum coverage limits and regulations in your state to avoid penalties or legal issues.

How No-Fault Insurance Works in Certain States

No-fault insurance systems, found in some states, allow policyholders to receive compensation from their own insurance company regardless of who is at fault in an accident. This system aims to expedite claims processing and reduce the need for litigation.

Comparing Online Quotes for Car Insurance

When looking for car insurance, comparing online quotes is a crucial step to ensure you get the best coverage at the most competitive rates. Here is a step-by-step guide on how to compare online insurance quotes effectively.

Importance of Obtaining Multiple Quotes

- Obtaining multiple quotes allows you to compare coverage options and premiums from different insurance companies.

- By getting quotes from various providers, you can find the best value for your money and tailor a policy that meets your specific needs.

- Comparing quotes helps you avoid overpaying for coverage that you may not require or missing out on essential protections.

How to Accurately Compare Coverage Options and Premiums

- Review the coverage limits and deductibles offered in each quote to ensure they align with your needs and budget.

- Consider the types of coverage included, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Look for any additional benefits or discounts that may be included in the policy, such as roadside assistance or safe driver rewards.

- Compare the premiums for each quote based on the coverage provided to determine the best value for your money.

Car Insurance for High-Risk Drivers

High-risk drivers, such as those with a young age, poor credit history, previous accidents, or traffic violations, often face higher insurance rates due to the increased likelihood of filing claims. These factors indicate a higher risk profile to insurance companies, resulting in the need for specialized coverage options.

Specialized High-Risk Insurance Options

For high-risk drivers struggling to find affordable coverage, specialized high-risk insurance companies or state-assigned risk plans may provide necessary options. These insurers cater specifically to individuals with challenging driving histories, offering coverage that meets their needs despite the associated risks.

Getting Quotes and Comparing Coverage

When seeking car insurance as a high-risk driver, it’s essential to obtain quotes from various providers to compare coverage options. By exploring different policies tailored for high-risk individuals, drivers can identify the most suitable and cost-effective solution for their specific circumstances.

Defensive Driving Courses for Lower Premiums

Completing defensive driving courses can be a proactive step for high-risk drivers to showcase responsible driving behavior. By improving their skills and demonstrating a commitment to safe driving practices, individuals can potentially lower their premiums and reduce the risk of future accidents.

Improving Driving Record for Standard Rates

High-risk drivers can take steps to enhance their driving record over time, eventually qualifying for standard insurance rates. By adhering to traffic laws, maintaining a clean record, and actively working to improve their driving habits, individuals can demonstrate their reliability as policyholders and potentially secure more favorable insurance terms in the future.

Future Trends in the Car Insurance Industry

As technology continues to advance at a rapid pace, the car insurance industry is also evolving to adapt to these changes. From emerging technologies to the rise of autonomous vehicles, the future of car insurance is set to undergo significant transformations.

Let’s delve into some of the key trends shaping the future of the car insurance industry.

Impact of Emerging Technologies

With the advent of technologies like artificial intelligence (AI) and big data analytics, car insurance companies are able to streamline their processes, improve risk assessment, and enhance customer experience. These technologies enable insurers to offer personalized policies based on individual driving habits and behaviors, leading to more accurate pricing and better coverage options.

Autonomous Vehicles and Insurance

The widespread adoption of autonomous vehicles is poised to revolutionize the car insurance landscape. As self-driving cars become more prevalent on the roads, traditional insurance models may need to be restructured to account for new liabilities and risks associated with this emerging technology.

Insurers will need to develop specialized policies tailored to autonomous vehicles to address unique coverage needs and potential safety concerns.

Changes in Business Models

The rise of InsurTech companies and digital platforms is reshaping the traditional business models of car insurance providers. These innovative startups are leveraging technology to offer on-demand insurance, usage-based policies, and seamless claims processing. As customer preferences shift towards digital solutions and personalized services, traditional insurers will need to adapt their offerings to remain competitive in the evolving market.

Predictive Analytics and Risk Management

By harnessing the power of predictive analytics and data-driven insights, car insurance companies can better assess risks, detect fraud, and optimize pricing strategies. Advanced risk management tools enable insurers to proactively identify potential issues and mitigate losses, leading to improved profitability and customer satisfaction.

Through predictive modeling, insurers can anticipate trends, behaviors, and market changes to stay ahead of the curve.

Closing Notes

Ready to hit the road with the best car insurance in the United States? With our comprehensive guide, you’ll be cruising with confidence in no time!

Helpful Answers

Why is car insurance important?

Car insurance protects you financially in case of accidents and helps you comply with legal requirements.

What factors affect car insurance premiums?

Factors like age, location, driving history, and type of vehicle can influence your insurance rates.

How can I save money on car insurance?

You can save by bundling policies, maintaining a good credit score, and choosing higher deductibles.

Which are some top car insurance companies in the U.S.?

Some top providers include Geico, State Farm, Progressive, Allstate, and USAA.

What are the different coverage options available?

Coverage options include liability, collision, comprehensive, and personal injury protection.