Auto insurance for high-risk drivers in United States sets the stage for a rollercoaster ride through the world of insurance, where twists and turns await at every corner.

Get ready to dive deep into the intricacies of coverage, costs, and strategies tailored specifically for high-risk drivers in the US.

Factors affecting auto insurance rates for high-risk drivers: Auto Insurance For High-risk Drivers In United States

When it comes to auto insurance rates for high-risk drivers, there are several factors that come into play. These factors can significantly impact the cost of insurance premiums. Let’s dive into some of the key elements that influence insurance rates for high-risk drivers.

Driving Record

A high-risk driving record, which includes accidents, traffic violations, and DUI convictions, can have a major impact on insurance rates. Insurance companies view drivers with a history of risky behavior as more likely to file a claim, leading to higher premiums to offset this risk.

Age and Gender

Younger drivers, especially teenagers, are often considered high-risk due to their lack of experience on the road. As a result, they typically face higher insurance rates. Additionally, gender can also play a role, with young male drivers generally facing higher premiums compared to young female drivers.

Location and Type of Vehicle

The location where you live can affect your insurance rates, as urban areas with higher rates of accidents and thefts may result in higher premiums. Furthermore, the type of vehicle you drive can also impact your rates, with sports cars and luxury vehicles typically costing more to insure due to their higher repair and replacement costs.

Credit Score

Believe it or not, your credit score can also influence your auto insurance rates. Insurers may use your credit history to predict the likelihood of you filing a claim. A lower credit score can result in higher premiums, as it may indicate a higher risk to the insurance company.

Types of coverage available for high-risk drivers

When it comes to auto insurance for high-risk drivers, there are several types of coverage options available to provide financial protection in case of accidents or other unforeseen events. Understanding these coverages is essential for making informed decisions about your policy.

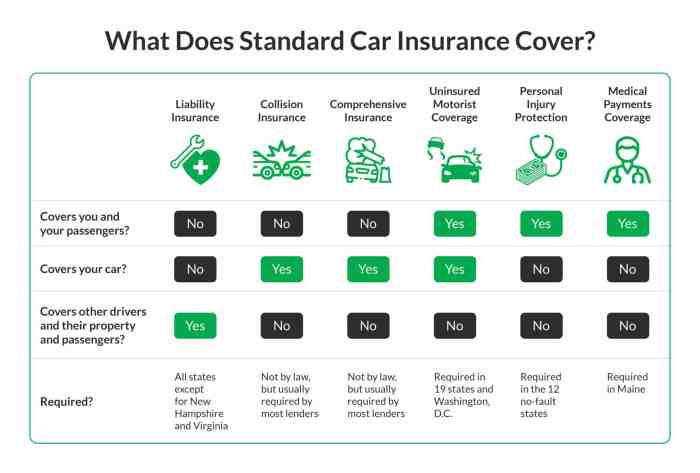

Liability coverage and its importance

Liability coverage is a fundamental component of auto insurance that helps pay for the costs associated with injuries or property damage you cause to others in an accident where you are at fault. It is required in most states and helps protect you from financial ruin in case of a lawsuit.

Collision and comprehensive coverage

Collision coverage helps pay for repairs to your vehicle after a collision with another vehicle or object, regardless of fault. Comprehensive coverage, on the other hand, covers damage to your car from non-collision events like theft, vandalism, or natural disasters.

Together, these coverages provide comprehensive protection for your vehicle.

Uninsured motorist protection

Uninsured motorist protection helps cover your medical expenses and vehicle repairs if you are involved in an accident with a driver who does not have insurance or is underinsured. This coverage ensures you are not left footing the bill for someone else’s negligence.

Optional coverages like roadside assistance and rental car reimbursement

In addition to the essential coverages mentioned above, high-risk drivers may benefit from optional coverages like roadside assistance and rental car reimbursement. Roadside assistance can provide peace of mind in case of breakdowns or emergencies, while rental car reimbursement can help cover the cost of a rental vehicle if your car is in the shop for repairs.

Specialized insurance companies catering to high-risk drivers

When it comes to high-risk drivers, there are specialized insurance companies that cater specifically to their needs. These companies understand the challenges faced by individuals with a less than perfect driving record and offer tailored solutions to help them get the coverage they need.

List of Specialized Insurance Companies

- Progressive

- The General

- Dairyland

- Titan Insurance

Comparison of Services and Rates

| Insurance Company | Services | Rates |

|---|---|---|

| Progressive | Flexible payment options, SR-22 filings | Competitive rates for high-risk drivers |

| The General | Instant online quotes, low down payments | Varies based on driving history |

| Dairyland | Specializes in non-standard auto insurance | Customized rates for high-risk drivers |

| Titan Insurance | 24/7 customer service, accident forgiveness | Discounts available for safe driving |

Eligibility Criteria for Specialized Insurers

Specialized insurance companies typically require high-risk drivers to provide proof of their driving record, including any past violations or accidents. Some insurers may also require SR-22 filings for drivers with serious infractions.

Assistance for Improving Driving Records

- Offering defensive driving courses

- Providing guidance on safe driving practices

- Rewarding safe driving behavior with discounts

Steps to reduce insurance costs for high-risk drivers

Driving as a high-risk driver often comes with higher insurance premiums. However, there are steps you can take to potentially reduce these costs and save money on your auto insurance.

Improving Driving Habits

One way to lower your insurance premiums is by improving your driving habits. Avoiding speeding tickets, accidents, and other traffic violations can help demonstrate to insurance companies that you are a responsible driver.

Defensive Driving Courses

Consider taking defensive driving courses to not only improve your skills on the road but also potentially qualify for discounts on your insurance premiums. These courses can show insurers that you are committed to safe driving practices.

Bundling Policies

Bundling your auto insurance with other policies, such as homeowners or renters insurance, can often lead to cost savings. Insurance companies may offer discounts for customers who have multiple policies with them.

Continuous Coverage

Maintaining continuous coverage without any lapses can help reduce your rates over time. Insurance providers may view continuous coverage as a sign of reliability and commitment to being insured.

Telematics Devices

Installing telematics devices in your vehicle that monitor your driving behavior could potentially lead to discounts based on your safe driving habits. These devices track things like speed, braking, and mileage.

Specialized High-Risk Insurance Companies

Consider exploring specialized insurance companies that cater specifically to high-risk drivers. These companies may offer competitive rates tailored to your driving history and risk profile.

Raising Deductibles

Another strategy to lower your monthly premiums is by raising your deductibles. By opting for a higher deductible, you may be able to lower the overall cost of your insurance policy.

Comparing Quotes

It’s essential to shop around and compare quotes from multiple insurance providers. By comparing rates, you can ensure you are getting the best possible deal for your coverage needs as a high-risk driver.

Are you looking to compare car insurance rates in the United States? Look no further! Check out this Car insurance rates comparison in United States to find the best deals and save money on your premiums. Don’t miss out on this helpful resource!

Affinity Groups

Joining affinity groups or organizations related to your profession or interests could potentially qualify you for group discounts on your auto insurance. These group discounts can help offset the higher costs associated with being a high-risk driver.

State-specific regulations for high-risk drivers

When it comes to high-risk drivers, state-specific regulations play a crucial role in determining insurance requirements, penalties, and programs available. Each state has its own set of rules and consequences for high-risk drivers, which can significantly impact their driving privileges and insurance rates.

Minimum insurance requirements for high-risk drivers in different states

In the United States, each state has its own minimum requirements for auto insurance coverage. High-risk drivers may be required to carry additional coverage or higher limits to meet state regulations. For example, some states may mandate higher liability limits or require uninsured motorist coverage for high-risk drivers.

State-run programs or initiatives for high-risk drivers

Some states have specific programs or initiatives in place to assist high-risk drivers in obtaining insurance coverage. These programs may offer affordable options or help connect drivers with insurance companies willing to provide coverage despite their high-risk status.

Impact of at-fault accidents on insurance rates based on state laws

State laws dictate how at-fault accidents affect insurance rates for high-risk drivers. In some states, an at-fault accident can lead to a significant increase in premiums, while in others, the impact may be less severe. Understanding these laws can help high-risk drivers anticipate the financial consequences of accidents.

Consequences of driving without insurance in various states

Driving without insurance is illegal in most states and can result in severe penalties for high-risk drivers. These consequences may include fines, license suspension, vehicle impoundment, and even legal action. High-risk drivers should be aware of the specific penalties in their state to avoid serious repercussions.

Comparison of penalties for high-risk drivers caught driving under the influence (DUI) in different states

DUI laws vary from state to state, leading to differing penalties for high-risk drivers caught driving under the influence. Penalties may include fines, license suspension, mandatory alcohol education programs, and even jail time. Understanding the consequences of a DUI in each state is crucial for high-risk drivers.

Process for high-risk drivers to reinstate their driver’s license after a suspension or revocation

After a license suspension or revocation, high-risk drivers must follow a specific process to reinstate their driving privileges. This process typically involves paying fines, completing any required courses or programs, and meeting other state requirements. Understanding the steps involved can help high-risk drivers regain their license sooner.

Additional educational courses or training programs available for high-risk drivers in certain states

Some states offer additional educational courses or training programs for high-risk drivers to improve their skills and reduce insurance costs. These programs may focus on defensive driving, traffic laws, or other relevant topics. Participating in these courses can benefit high-risk drivers by enhancing their driving abilities and potentially lowering insurance rates.

Impact of DUIs and SR-22 insurance on high-risk drivers

Driving under the influence (DUI) is a serious offense that can have significant repercussions, especially for high-risk drivers. Let’s delve into how DUIs and SR-22 insurance impact high-risk drivers in the United States.

SR-22 Insurance and Its Requirements

- SR-22 insurance is a certificate of financial responsibility that proves a driver has the minimum required auto insurance coverage.

- It is typically required for high-risk drivers who have been convicted of serious traffic violations, such as DUIs.

- High-risk drivers may need to file for SR-22 insurance with their state’s Department of Motor Vehicles (DMV) to reinstate their driving privileges.

Effect of DUI Convictions on Insurance Rates and Coverage, Auto insurance for high-risk drivers in united states

- A DUI conviction can lead to significantly higher insurance rates for high-risk drivers due to the increased likelihood of future accidents.

- Insurance companies may also limit coverage options for drivers with DUIs, making it challenging to find affordable policies.

- Some insurers may specialize in providing coverage for high-risk drivers with DUI convictions, albeit at higher premiums.

Obtaining and Maintaining SR-22 Insurance

- High-risk drivers with DUI convictions must contact their insurance provider to request an SR-22 filing.

- They need to pay a fee to have the SR-22 form submitted to the state DMV on their behalf.

- Drivers must maintain continuous coverage and ensure that their insurance company informs the DMV of any policy cancellations.

Tips for High-Risk Drivers with DUIs

- Drive responsibly and follow all traffic laws to improve your driving record over time.

- Consider enrolling in a defensive driving course to demonstrate your commitment to safe driving practices.

- Compare insurance quotes from multiple providers to find the best rates for high-risk drivers with DUIs.

Consequences of Failing to Maintain SR-22 Insurance

- Failure to maintain SR-22 insurance after a DUI conviction can result in license suspension or revocation.

- Reinstating driving privileges after a lapse in SR-22 coverage may be costly and time-consuming.

- High-risk drivers must prioritize keeping their SR-22 insurance current to avoid legal penalties.

Strategies to Improve Driving Record and Reduce Premiums

- Avoid traffic violations and accidents to demonstrate responsible driving behavior to insurers.

- Seek opportunities to lower insurance premiums, such as bundling policies or qualifying for discounts.

- Consider alternative insurance options, such as non-standard or high-risk insurance providers, to find affordable coverage.

Comparison of insurance quotes for high-risk drivers

When it comes to high-risk drivers, comparing insurance quotes is crucial to finding the best coverage at an affordable rate. Here is a step-by-step guide on how to obtain and compare insurance quotes effectively.

Step-by-step guide on obtaining and comparing insurance quotes

- Start by gathering your driving history, including any violations or accidents.

- Research insurance companies that specialize in high-risk drivers.

- Request quotes from multiple insurers, providing the same information for accurate comparisons.

- Compare coverage options, limits, deductibles, and premiums to find the best fit for your needs.

How to analyze coverage limits and deductibles in quotes

- Look at the coverage limits to ensure they meet your state’s minimum requirements.

- Consider how deductibles affect your out-of-pocket expenses in the event of a claim.

- Balance coverage limits and deductibles to find a policy that offers adequate protection without breaking the bank.

The importance of reviewing policy details before making a decision

- Read through the policy documents carefully to understand the coverage provided.

- Pay attention to exclusions, limitations, and any additional fees that may apply.

- Ask questions and seek clarification from the insurance company if anything is unclear.

Resources for high-risk drivers to compare quotes effectively

- Use online comparison tools to get quotes from multiple insurers in one place.

- Consult with an independent insurance agent who can help you navigate the process.

- Check with your state’s department of insurance for resources and information on high-risk coverage options.

Strategies for finding affordable auto insurance as a high-risk driver

When you are considered a high-risk driver, finding affordable auto insurance can be challenging. However, with the right strategies and approach, you can still secure suitable coverage without breaking the bank.

Ways to shop around and get quotes from multiple insurers

- Utilize online comparison tools to easily gather quotes from multiple insurance companies.

- Contact insurance agents directly to inquire about specific high-risk driver policies and rates.

- Consider reaching out to specialized insurance providers that cater to high-risk drivers.

Discuss the option of joining group insurance plans for potential discounts

- Explore group insurance plans offered by organizations, employers, or professional associations for possible discounted rates.

- Check if any groups or clubs you are affiliated with offer group insurance options for members.

Provide tips for negotiating with insurance companies for better rates

- Highlight any defensive driving courses or safety features on your vehicle that could lower your premiums.

- Be prepared to negotiate deductibles, coverage limits, and other policy details to potentially reduce costs.

- Show a history of improved driving behavior or steps taken to mitigate risks to demonstrate your commitment to safe driving.

Share insights on leveraging technology to find affordable coverage options

- Use insurance comparison websites and apps to easily compare rates and coverage options from different insurers.

- Consider using telematics devices or apps that track your driving behavior for potential discounts based on safe driving habits.

Develop a comparison table detailing coverage options, deductibles, and premiums from different insurance providers

| Insurance Company | Coverage Options | Deductibles | Premiums |

|---|---|---|---|

| Company A | Full coverage | $500 | $1500/year |

| Company B | Liability only | $1000 | $1200/year |

Include a step-by-step guide on how to fill out insurance quote forms accurately

- Gather all necessary information such as your driver’s license, vehicle details, and driving history.

- Provide accurate and up-to-date information to ensure the quotes you receive are as precise as possible.

- Double-check all details before submitting the form to avoid any errors that could impact your quotes.

Create a blockquote with sample negotiation scripts to use when discussing rates with insurance companies

“I have completed a defensive driving course and installed safety features in my car. Can we discuss potential discounts based on these factors?”

Recommend specific insurance comparison websites or apps known for catering to high-risk drivers

- Check out websites like The Zebra, Gabi, and Compare.com for tailored insurance comparisons for high-risk drivers.

- Consider using apps like EverQuote and Insurify for easy access to multiple insurance quotes on your mobile device.

Suggest reaching out to independent insurance agents for personalized assistance in finding suitable coverage

- Independent insurance agents can offer personalized guidance and access to a variety of insurance options tailored to high-risk drivers.

- They can help navigate the complexities of high-risk insurance and find the best coverage at competitive rates.

Challenges faced by high-risk drivers in obtaining auto insurance

High-risk drivers often face numerous obstacles when trying to secure auto insurance coverage. These challenges can stem from a variety of factors, including driving history, age, and even the type of vehicle being insured. Let’s delve into some common issues faced by high-risk drivers in obtaining auto insurance.

Identification as a high-risk driver

When insurers label an individual as a high-risk driver, it can have significant implications on their ability to obtain affordable coverage. Factors such as multiple accidents, traffic violations, or a DUI conviction can lead to this classification.

Lapses in coverage affecting future options

High-risk drivers may have experienced lapses in their insurance coverage due to various reasons, which can further complicate their ability to find affordable options in the future. Insurers may view gaps in coverage as a red flag, leading to higher premiums.

Navigating insurance challenges

High-risk drivers often find themselves searching for specialized insurance companies that cater to their unique needs. Seeking advice from other high-risk drivers who have successfully navigated insurance challenges can be valuable in finding suitable coverage options.

Impact of traffic violations on auto insurance premiums

Driving violations can have a significant impact on auto insurance premiums for high-risk drivers. Insurance companies consider traffic violations as a sign of increased risk, leading to higher premiums to offset the potential cost of insuring a driver with a history of violations.

How speeding tickets and other violations affect insurance rates

- Speeding tickets and other violations typically lead to an increase in insurance rates for high-risk drivers.

- Insurance companies view these violations as indicators of risky behavior on the road, which can result in accidents and claims.

The role of points on a driving record in determining premiums

- Points on a driving record are a way for insurance companies to assess the risk associated with a driver.

- Drivers with more points are considered higher risk and may face higher insurance premiums as a result.

How the severity of violations impacts insurance costs

- More severe violations, such as DUIs or reckless driving, can have a greater impact on insurance costs compared to minor infractions like a rolling stop.

- These serious violations signal a higher level of risk and can lead to substantial increases in premiums.

Strategies for high-risk drivers to mitigate the effects of traffic violations on premiums

- High-risk drivers can consider taking defensive driving courses to demonstrate a commitment to safe driving practices, potentially reducing the impact of violations on premiums.

- Being proactive in addressing traffic violations promptly and improving driving habits can also help mitigate the long-term effects on insurance costs.

Examples of common traffic violations that have a significant impact on insurance premiums

- DUIs

- Reckless driving

- Running red lights

- At-fault accidents

The process of appealing or reducing points on a driving record to lower insurance costs

- Drivers can often appeal or attend traffic school to reduce points on their driving record, which can help lower insurance costs over time.

- Consulting with the DMV or a legal professional can provide guidance on the best course of action to reduce points and mitigate insurance impacts.

The long-term effects of multiple traffic violations on insurance premiums

- Accumulating multiple traffic violations over time can lead to significantly higher insurance premiums for high-risk drivers.

- Insurance companies may view a pattern of violations as a persistent risk factor, resulting in continued premium increases.

How completing defensive driving courses can help offset the impact of traffic violations on insurance rates

- Defensive driving courses can demonstrate a commitment to safer driving practices, potentially leading to discounts on insurance premiums for high-risk drivers.

- Insurance companies may view completion of these courses as a positive step towards reducing risk and mitigating the impact of past violations.

Importance of maintaining continuous coverage for high-risk drivers

Maintaining continuous coverage is crucial for high-risk drivers as it directly impacts their insurance rates and overall financial stability. Let’s delve into why consistent coverage is essential for this group of drivers.

Impact of coverage gaps on insurance rates

- Insurance companies view gaps in coverage as a red flag for high-risk drivers, leading to higher insurance rates.

- Driving without insurance or letting a policy lapse can result in penalties and fines, exacerbating the financial burden for high-risk individuals.

Benefits of continuous coverage for high-risk drivers

- Continuous coverage demonstrates responsibility and commitment to safe driving practices, potentially leading to lower insurance premiums over time.

- In the event of an accident or unforeseen circumstances, having consistent coverage ensures that high-risk drivers are financially protected and can access necessary resources.

Consequences of letting an insurance policy lapse

- Letting an insurance policy lapse can result in a loss of coverage, leaving high-risk drivers vulnerable to financial risks and legal consequences.

- Reinstating a lapsed policy often comes with higher premiums and additional fees, further straining the financial resources of high-risk individuals.

Tips for maintaining consistent coverage

- Set up automatic payments or reminders to ensure timely payment of insurance premiums.

- Regularly review and update your policy to reflect any changes in your driving record or personal circumstances.

- Consider bundling auto insurance with other policies to potentially qualify for discounts and lower rates.

Reinstating an insurance policy after lapsing

- Contact your insurance provider immediately to discuss options for reinstating your policy.

- Be prepared to pay any outstanding premiums, fees, and potentially higher rates to get your coverage back in place.

Insurance options for high-risk drivers

- Specialized insurance companies offer coverage tailored to high-risk drivers, providing necessary protection at competitive rates.

- These policies may include additional features such as accident forgiveness or roadside assistance to meet the specific needs of high-risk individuals.

Checklist for avoiding coverage lapses

- Set up recurring payments or reminders for insurance premiums.

- Regularly review your policy and coverage options to ensure they align with your driving needs.

- Drive responsibly and follow traffic laws to maintain a clean driving record and qualify for lower insurance rates.

Options for high-risk drivers with non-standard insurance needs

Non-standard insurance is designed for high-risk drivers who may have a history of accidents, traffic violations, or DUIs. These drivers are considered riskier to insure by traditional insurance companies, leading to the need for specialized non-standard policies.

Coverage Limitations and Higher Premiums

Non-standard insurance policies often come with coverage limitations and higher premiums compared to standard insurance. These policies may offer basic liability coverage with limited options for comprehensive and collision coverage. The premiums for non-standard insurance are usually higher due to the increased risk associated with insuring high-risk drivers.

Transitioning to Standard Insurance

High-risk drivers can work on improving their driving record to qualify for standard insurance. This may involve maintaining a clean driving record over a certain period, completing defensive driving courses, or taking steps to reduce risky driving behaviors. By demonstrating improved driving habits, high-risk drivers can eventually transition to standard insurance policies with lower premiums.

Resources and Tips for High-Risk Drivers

High-risk drivers with unique insurance needs can seek guidance from insurance agents specializing in non-standard policies. These agents can help high-risk drivers understand their options, compare quotes, and find the most suitable coverage for their specific needs. Additionally, resources such as online forums, support groups, and educational materials can provide valuable information for high-risk drivers looking to navigate the insurance market.

Improving Driving Record for Standard Insurance

High-risk drivers can take steps to improve their driving record and qualify for standard insurance. This may include practicing safe driving habits, avoiding traffic violations, and staying up to date on insurance requirements. By consistently demonstrating responsible driving behavior, high-risk drivers can enhance their eligibility for standard insurance coverage.

Are you looking for the best car insurance rates in the United States? Look no further! Check out this car insurance rates comparison in United States to find the perfect coverage for your vehicle.

Comparison Table: Standard vs. Non-Standard Insurance

| Aspect | Standard Insurance | Non-Standard Insurance |

|---|---|---|

| Coverage Options | Comprehensive, Collision, Liability | Basic Liability |

| Premiums | Lower | Higher |

| Eligibility | Clean Driving Record | High-Risk Drivers |

Real-life Example: John, a high-risk driver with multiple traffic violations, completed a defensive driving course and maintained a clean record for two years. As a result, he was able to transition from a non-standard insurance policy to a standard one, reducing his premiums significantly.

Resources and support available for high-risk drivers seeking insurance

When it comes to high-risk drivers seeking insurance, there are several organizations, programs, and professionals that can provide assistance and support in navigating the insurance market.

Organizations and Programs

- Non-profit organizations like the Insurance Information Institute (III) offer resources and education on insurance options for high-risk drivers.

- State-specific programs such as assigned risk plans or automobile insurance plans can help high-risk drivers obtain coverage when traditional insurers deny them.

- The National Association of Insurance Commissioners (NAIC) provides information on insurance regulations and consumer rights, which can be beneficial for high-risk drivers.

Role of Insurance Agents and Brokers

- Insurance agents and brokers play a crucial role in helping high-risk individuals find suitable coverage by leveraging their industry knowledge and network of insurance providers.

- They can assist in comparing quotes, explaining policy details, and advocating for high-risk drivers to ensure they receive fair treatment from insurance companies.

Tips for Finding Reliable Information

- Consulting with multiple insurance agents or brokers can provide a comprehensive understanding of available options for high-risk drivers.

- Utilizing online resources such as state insurance department websites or consumer advocacy websites can offer insights into insurance regulations and consumer protections.

- Seeking recommendations from friends, family, or support groups for high-risk drivers can help in identifying reputable insurance professionals.

Government Initiatives and Support

- Some states offer assistance programs or subsidies for high-risk drivers to access affordable insurance coverage.

- Government agencies like the Department of Insurance may provide guidance and support in resolving insurance issues faced by high-risk drivers.

- Legislation aimed at improving insurance accessibility for high-risk individuals, such as reforming assigned risk plans, can also contribute to better insurance options.

Future trends and developments in auto insurance for high-risk drivers

As advancements in technology continue to reshape various industries, the auto insurance sector is no exception. High-risk drivers are likely to see significant changes in their insurance options in the near future. It is crucial for high-risk drivers to stay informed about these potential developments to make well-informed decisions regarding their insurance coverage.

Impact of Technology on Insurance Options

With the rise of telematics and usage-based insurance, high-risk drivers may have access to more personalized insurance plans. By having their driving behavior monitored through devices installed in their vehicles, high-risk drivers could potentially demonstrate safer habits and qualify for lower premiums.

This shift towards data-driven insurance models could offer high-risk drivers a more tailored and affordable coverage option.

Regulatory Changes Affecting High-Risk Driver Coverage

Future regulations may also play a significant role in shaping insurance options for high-risk drivers. Changes in state laws regarding factors like distracted driving, speeding, or impaired driving could impact insurance rates for high-risk individuals. It is essential for high-risk drivers to stay updated on these regulatory changes to understand how they might affect their coverage options and premiums.

Industry Approach to High-Risk Drivers

As the insurance industry evolves, there may be a shift in how insurance companies perceive and serve high-risk drivers. Insurers could potentially develop more specialized products and services tailored to the needs of high-risk individuals. High-risk drivers might benefit from increased competition among insurers, leading to more affordable and comprehensive coverage options.

Adapting to Upcoming Changes in Auto Insurance

To adapt to the future trends in auto insurance for high-risk drivers, individuals in this category should proactively explore alternative coverage options, such as non-standard insurance providers. High-risk drivers can also focus on improving their driving record, attending defensive driving courses, and maintaining continuous coverage to demonstrate their commitment to safe driving practices.

By staying informed and proactive, high-risk drivers can navigate the evolving insurance landscape more effectively.

Outcome Summary

As we wrap up this journey into the realm of auto insurance for high-risk drivers in the United States, remember that knowledge is your best tool for navigating the roads ahead safely and confidently.

FAQ Section

Can high-risk drivers still get affordable insurance?

Yes, by exploring specialized insurers and implementing strategies like improving driving habits or bundling policies.

How do traffic violations affect insurance premiums for high-risk drivers?

Traffic violations can significantly increase premiums, but completing defensive driving courses can help mitigate the impact.

What is SR-22 insurance, and when is it required?

SR-22 insurance is a certificate of financial responsibility required after serious traffic violations, such as DUIs.