Kicking off with Full coverage auto insurance for new drivers in United States, buckle up as we dive into the world of insurance for new drivers, exploring everything from coverage types to discounts and the best insurance companies.

Overview of Full Coverage Auto Insurance for New Drivers in the United States: Full Coverage Auto Insurance For New Drivers In United States

Full coverage auto insurance for new drivers typically includes liability, collision, and comprehensive coverage. It provides financial protection in case of accidents, theft, or damage to your vehicle.

Importance of Having Full Coverage for New Drivers

Having full coverage auto insurance is crucial for new drivers as they are often considered high-risk due to their lack of experience on the road. It helps protect them financially in case of accidents and ensures they comply with legal requirements.

Legal Requirements for Auto Insurance in the United States

- All states in the US require drivers to have a minimum amount of auto insurance coverage to legally operate a vehicle.

- Minimum requirements typically include liability coverage to cover damages to others in an accident that you are found at fault for.

- Some states also require additional coverage, such as uninsured/underinsured motorist coverage or personal injury protection.

- Driving without the required insurance can result in fines, license suspension, or even legal action.

Factors Affecting the Cost of Full Coverage Auto Insurance

When it comes to full coverage auto insurance for new drivers in the United States, several factors play a significant role in determining the cost of insurance premiums. Let’s explore some of the key factors that influence how much you pay for your coverage.

Age Impact on Insurance Costs

Age is a crucial factor that affects the cost of auto insurance for new drivers. Younger drivers, especially teenagers, tend to pay higher premiums due to their lack of driving experience and higher likelihood of being involved in accidents.

Type of Vehicle and Insurance Premiums

The type of vehicle you drive can also impact your insurance rates. Sports cars or luxury vehicles typically come with higher insurance premiums compared to more affordable and practical cars. Insurance companies assess the risk associated with the make and model of your vehicle when determining your premium.

Role of Location in Insurance Rates

Where you live plays a significant role in determining your insurance rates. Urban areas with higher rates of accidents and thefts generally have higher insurance premiums compared to rural areas. Additionally, states have different insurance requirements and regulations that can influence the cost of coverage.

Driving Record and Experience Impact

Your driving record and experience are crucial factors in determining insurance costs. Drivers with a clean record and several years of driving experience are likely to pay lower premiums compared to those with a history of accidents or traffic violations.

Cost Difference Between New and Used Cars

Insuring a new car is typically more expensive than insuring a used car. New cars have higher values, which means higher repair or replacement costs for the insurance company in case of an accident. Used cars are generally cheaper to insure due to their lower market value.

Effect of Annual Mileage on Premiums

The number of miles you drive annually can affect your insurance premiums. Drivers who have a longer daily commute or frequently drive long distances are considered to have a higher risk of accidents, leading to higher insurance rates compared to those who drive less frequently.

Impact of Credit Score on Insurance Costs

Your credit score can also impact the cost of auto insurance. Insurance companies often use credit history as a factor in determining premiums, with lower credit scores potentially leading to higher insurance rates.

Influence of Gender on Insurance Rates

While some states have prohibited gender-based pricing, historically, gender has been a factor in determining insurance rates. Statistics show that young male drivers tend to be involved in more accidents compared to young female drivers, leading to higher premiums for males in some cases.

Types of Coverage Included in Full Coverage Auto Insurance

When it comes to full coverage auto insurance for new drivers in the United States, there are several types of coverage included to provide comprehensive protection. Let’s delve into the details of each type of coverage and how they benefit new drivers.

Liability Coverage

Liability coverage is a mandatory component of full coverage auto insurance and helps cover costs associated with injuries or property damage you cause to others in an at-fault accident. This coverage does not protect your own vehicle but is crucial for protecting your assets in case of a lawsuit.

Are you familiar with auto insurance liability coverage in the United States? If not, you might want to check out this informative article on auto insurance liability coverage in the United States. It’s essential to understand the basics of this type of coverage to ensure you have the right protection in case of an accident.

- Benefit: Protects you financially from costly lawsuits

- Scenario: If you rear-end another vehicle and the driver sustains injuries, liability coverage will help cover their medical expenses.

Collision Coverage

Collision coverage helps pay for repairs or replacement of your vehicle if it’s damaged in a collision with another vehicle or object, regardless of fault. This coverage is especially important for new drivers who may be more prone to accidents.

- Benefit: Ensures your vehicle is repaired or replaced after an accident

- Scenario: If you accidentally hit a tree while learning to parallel park, collision coverage will cover the cost of repairing your car.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from non-collision related incidents, such as theft, vandalism, or natural disasters. This coverage is valuable for new drivers who want to safeguard their vehicle from various risks.

- Benefit: Offers protection against a wide range of risks

- Scenario: If your parked car is vandalized with graffiti, comprehensive coverage will help cover the cost of repairs.

Coverage Limits and Deductibles

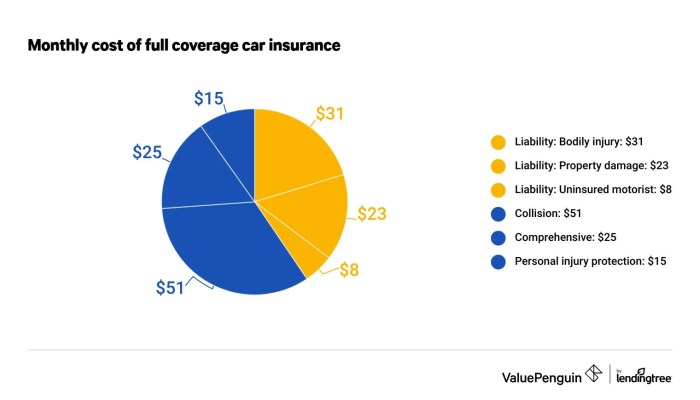

It’s important to understand the specific coverage limits and deductibles for each type of coverage. Here is a chart outlining the typical limits and deductibles for liability, collision, and comprehensive coverage:

| Type of Coverage | Coverage Limits | Deductible |

|---|---|---|

| Liability | Varies by state | Usually between $500

|

| Collision | Actual cash value of vehicle | Typically $500

|

| Comprehensive | Actual cash value of vehicle | Usually $250

|

Filing a Claim and Maximizing Coverage Benefits

When it comes to filing a claim for each type of coverage, it’s important to report the incident promptly to your insurance provider and provide all necessary documentation. New drivers can maximize the benefits of each type of coverage by driving safely, maintaining a clean driving record, and choosing appropriate coverage limits and deductibles based on their budget and needs.

Discounts and Savings Opportunities for New Drivers

When it comes to full coverage auto insurance for new drivers in the United States, there are various discounts and savings opportunities that can help reduce insurance costs significantly. These discounts are designed to reward responsible behavior and help new drivers manage their insurance premiums effectively.

Good Grades Discount

- Many insurance companies offer a good grades discount for new drivers who maintain a certain GPA, typically a B average or higher.

- To qualify for this discount, new drivers may need to provide their latest report card or transcripts to prove their academic performance.

- By maintaining good grades, new drivers can save up to 15% on their auto insurance premiums.

Defensive Driving Course Discount

- Completing a defensive driving course can also lead to a discount on auto insurance for new drivers.

- New drivers can enroll in an approved course either online or in person to learn safe driving techniques and traffic laws.

- Upon completion, new drivers can provide a certificate of completion to their insurance company to apply the discount, saving up to 10% on their premiums.

Multi-Car Discount

- New drivers who insure multiple vehicles under the same policy may be eligible for a multi-car discount.

- This discount rewards drivers for bundling their insurance policies and can result in significant savings on premiums.

- To qualify, new drivers must insure all vehicles in their household under the same policy with the same insurance provider.

Safety Features Discount, Full coverage auto insurance for new drivers in united states

- New drivers with vehicles equipped with safety features such as anti-lock brakes, airbags, and anti-theft devices may qualify for a safety features discount.

- Insurance companies offer this discount to encourage the use of safety technology that reduces the risk of accidents and injuries.

- By providing proof of these safety features, new drivers can enjoy lower insurance premiums and increased savings.

Low Mileage Discount

- New drivers who drive fewer miles than the average driver may be eligible for a low mileage discount.

- This discount is based on the premise that drivers who drive less are less likely to be involved in accidents.

- By accurately reporting their mileage and driving habits to their insurance company, new drivers can save on their premiums with this discount.

Best Insurance Companies Offering Full Coverage for New Drivers

When it comes to finding the best insurance company for new drivers, affordability, coverage options, and customer service are crucial factors to consider. Below is a list of some of the top insurance companies known for providing affordable full coverage to new drivers.

State Farm

State Farm is a popular choice for new drivers due to its competitive rates and excellent customer service. They offer a variety of coverage options, including liability, collision, and comprehensive coverage.

Geico

Geico is another top insurance company for new drivers, known for its low rates and user-friendly online platform. They offer a range of coverage options and discounts for new drivers.

Progressive

Progressive is a well-established insurance company that offers full coverage options for new drivers at competitive prices. They also provide additional coverage options such as roadside assistance and rental car reimbursement.

Allstate

Allstate is known for its personalized service and comprehensive coverage options. They offer various discounts for new drivers, making it an attractive option for those looking for affordable full coverage.

USAA

USAA is a top choice for military members and their families, offering competitive rates and excellent customer service. They provide full coverage options tailored to the needs of new drivers.

It is important for new drivers to consider additional coverage options such as roadside assistance or rental car reimbursement, as these can provide extra peace of mind in case of emergencies.

Understanding Deductibles and Coverage Limits

When it comes to full coverage auto insurance for new drivers in the United States, understanding deductibles and coverage limits is crucial. Let’s delve into the details to help new drivers make informed decisions about their insurance policies.

Deductibles in Insurance

In the context of insurance, deductibles refer to the amount of money a policyholder must pay out of pocket before their insurance coverage kicks in to cover the rest of the claim. For example, if you have a $500 deductible and file a claim for $2,000 in damages, you would pay $500, and the insurance company would cover the remaining $1,500.

- Higher deductibles usually result in lower insurance premiums. This is because you are taking on more financial responsibility upfront, reducing the insurer’s risk.

- For new drivers, opting for a higher deductible can help lower monthly premiums, making insurance more affordable.

- However, it’s essential to consider your personal financial situation and risk tolerance. While a higher deductible can save money in the long run, you should ensure you can cover the deductible amount if a claim arises.

Coverage Limits in Insurance

Coverage limits determine the maximum amount an insurance company will pay for a covered loss. For example, if you have a coverage limit of $50,000 for property damage and the incurred damage amounts to $70,000, you would be responsible for the remaining $20,000.

- It’s crucial to evaluate your individual needs and circumstances to determine appropriate coverage limits for different types of insurance. For auto insurance, consider factors like the value of your vehicle and potential liability risks.

- Higher coverage limits typically result in higher premiums but provide more extensive protection in the event of a severe accident or loss.

- Choosing the right coverage limits ensures you are adequately protected without overpaying for insurance.

Reviewing and Adjusting Deductibles and Coverage Limits

To ensure you have the right balance of protection and affordability, follow these steps to review and adjust your deductibles and coverage limits:

- Assess your current financial situation and risk tolerance.

- Consider the value of your assets and potential liabilities.

- Compare different deductible and coverage limit combinations to determine the most suitable options for your needs.

- Regularly review your insurance policy and make adjustments as needed to ensure you have adequate protection without paying more than necessary.

Steps to Take When Getting Full Coverage Auto Insurance as a New Driver

When obtaining full coverage auto insurance as a new driver, there are several important steps to follow to ensure you get the best policy for your needs.

Gather Necessary Documents and Information

- Driver’s license: You will need a valid driver’s license to apply for auto insurance.

- Vehicle information: Details about your car, such as make, model, year, and VIN.

- Driving history: Information about any past accidents or traffic violations.

- Personal information: Your name, address, contact details, and any other relevant personal information.

Compare Quotes from Different Insurance Providers

- Research: Look into various insurance companies and compare their coverage options and rates.

- Get multiple quotes: Obtain quotes from at least three different providers to compare prices and coverage.

- Consider coverage limits: Make sure you understand the coverage limits and deductibles offered by each provider.

- Ask about discounts: Inquire about any available discounts for new drivers, such as good student discounts or safe driver discounts.

Dealing with Accidents and Claims Under Full Coverage

As a new driver with full coverage auto insurance, it’s crucial to understand the necessary steps to take in the event of an accident to ensure a smooth claims process and protect yourself financially.

Steps to Take in the Event of an Accident

- Ensure Safety: First and foremost, check for injuries and move to a safe location if possible.

- Contact Authorities: Call the police to report the accident and file a report.

- Exchange Information: Collect details from the other driver(s) involved, including names, contact information, insurance details, and vehicle information.

- Document the Scene: Take photos of the accident scene, damage to vehicles, and any relevant details.

- Notify Your Insurance Company: Contact your insurance provider as soon as possible to report the accident and initiate the claims process.

Claims Process for Full Coverage Auto Insurance

- File a Claim: Submit a claim to your insurance company with all the necessary documentation, including the police report, photos, and witness statements.

- Claims Investigation: The insurance company will investigate the claim, assess the damages, and determine coverage based on your policy.

- Repair Process: Once the claim is approved, you can proceed with repairing your vehicle at an approved repair shop or with a provider of your choice.

- Settlement: After the repairs are completed, your insurance company will provide compensation based on your coverage and deductibles.

Guidance for a Smooth Claims Experience

- Be Honest and Accurate: Provide truthful and accurate information to your insurance company to avoid any delays or complications in the claims process.

- Follow Instructions: Cooperate with your insurance company and follow their instructions to ensure a smooth and efficient claims experience.

- Keep Records: Keep all documentation related to the accident and claims process, including emails, correspondence, and receipts for expenses.

- Stay Informed: Stay informed about the progress of your claim and reach out to your insurance company if you have any questions or concerns.

Common Misconceptions About Full Coverage Auto Insurance for New Drivers

As new drivers navigate the world of auto insurance, there are several common misconceptions that can lead to confusion. Let’s address some of the myths and misconceptions surrounding full coverage auto insurance for new drivers in the United States.

Full Coverage Means Everything is Covered

One of the most common misconceptions about full coverage auto insurance is that it covers absolutely everything. In reality, full coverage typically includes comprehensive and collision coverage, but there may still be limitations and exclusions. It’s essential for new drivers to understand the specific details of their policy to avoid any surprises in case of an accident.

Full Coverage Is Too Expensive for New Drivers

Another misconception is that full coverage auto insurance is too expensive for new drivers. While it’s true that full coverage can be more costly than liability-only coverage, there are ways for new drivers to find affordable options. By comparing quotes, taking advantage of discounts, and maintaining a clean driving record, new drivers can often find competitive rates for full coverage.

Full Coverage Is Unnecessary for New Drivers

Some new drivers may believe that full coverage is unnecessary, especially if they have an older or less valuable vehicle. However, full coverage can provide valuable protection in the event of an accident, theft, or other unforeseen circumstances. It’s important for new drivers to weigh the potential risks and benefits of full coverage before making a decision.

Legal Rights and Responsibilities of New Drivers with Full Coverage

As a new driver with full coverage auto insurance, it is essential to understand both your legal rights and responsibilities. These aspects play a crucial role in ensuring you are adequately protected while on the road.

Legal Rights of New Drivers with Full Coverage

- New drivers with full coverage have the right to file a claim with their insurance company in the event of an accident or damage to their vehicle.

- They have the right to be provided with the coverage Artikeld in their policy, which may include liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- New drivers also have the right to seek legal assistance if their insurance company fails to fulfill their obligations under the policy.

Responsibilities of New Drivers with Full Coverage

- New drivers are responsible for paying their insurance premiums on time to maintain continuous coverage.

- They have the responsibility to adhere to the terms and conditions Artikeld in their policy, such as reporting accidents promptly and providing accurate information to their insurance company.

- New drivers also have the responsibility to drive safely and follow all traffic laws to minimize the risk of accidents and insurance claims.

Technology and Innovations Impacting Full Coverage Auto Insurance

Technology is rapidly changing the landscape of auto insurance, especially for new drivers in the United States. From telematics to artificial intelligence (AI), these innovations are reshaping how insurance companies assess risk and determine premiums.

Telematics and AI in Auto Insurance

Telematics technology, which involves tracking driving behavior through devices installed in vehicles, allows insurance companies to personalize premiums based on actual driving habits. This can benefit new drivers by incentivizing safe driving practices and potentially lowering insurance costs. On the other hand, the use of AI in auto insurance helps streamline claim processing, detect fraud, and enhance customer service.

However, there are concerns about privacy and data security with the collection of personal driving data.

Blockchain Technology and Security

Blockchain technology is being explored by insurance companies to improve the security and transparency of transactions. By utilizing blockchain, insurers can create a secure and tamper-proof record of policyholder information and claims history. This can help prevent fraud and ensure smoother claim settlements for new drivers.

Machine Learning for Fraud Detection

Machine learning algorithms are increasingly used in auto insurance to predict and prevent fraudulent claims. By analyzing vast amounts of data, these algorithms can identify patterns and anomalies that indicate potential fraud. This technology helps protect insurers from false claims and ultimately benefits new drivers by reducing the overall cost of insurance.

Self-Driving Cars and Insurance Adaptations

The rise of self-driving cars poses a unique challenge for the auto insurance industry. As autonomous vehicles become more prevalent, insurance companies are adapting their coverage models to account for the reduced risk of accidents. Some insurers are exploring partnerships with car manufacturers to offer specialized insurance for self-driving vehicles.

This shift may impact the availability and pricing of full coverage auto insurance for new drivers in the future.

Traditional Risk Assessment vs. Big Data Analytics

While traditional risk assessment methods rely on historical data and actuarial models to set insurance premiums, big data analytics offer a more dynamic and personalized approach. By leveraging vast amounts of real-time data, insurers can better assess risk, tailor coverage options, and adjust premiums accordingly.

This shift towards data-driven decision-making has the potential to benefit new drivers by providing more accurate and affordable insurance options.

Tips for New Drivers to Lower Full Coverage Auto Insurance Costs

As a new driver, it’s important to explore ways to reduce your full coverage auto insurance costs to make it more affordable. Here are some strategies that can help you lower your insurance premiums:

Maintain a Clean Driving Record

Maintaining a clean driving record is essential for new drivers looking to lower their insurance costs. Avoiding traffic violations and accidents can demonstrate to insurance companies that you are a responsible driver, which can lead to lower premiums.

Take Defensive Driving Courses

Taking defensive driving courses can not only help you become a safer driver but can also lead to discounts on your insurance premiums. Insurance companies often offer reduced rates to drivers who have completed approved defensive driving courses.

Compare Quotes from Multiple Insurance Companies

It’s important to shop around and compare quotes from multiple insurance companies to find the best rates. Different insurers may offer varying discounts and incentives for new drivers, so it’s worth exploring your options to find the most affordable coverage.

Opt for a Higher Deductible

Opting for a higher deductible can help lower your monthly insurance payments. While a higher deductible means you’ll have to pay more out of pocket in the event of a claim, it can result in lower premiums overall.

Utilize Safety Features for Discounts

Installing safety features in your vehicle, such as anti-theft devices, airbags, and anti-lock brakes, can lead to insurance discounts. Insurance companies often reward drivers who prioritize safety, so be sure to take advantage of any available discounts for safety features.

Understanding Exclusions and Limitations in Full Coverage Auto Insurance

When it comes to full coverage auto insurance for new drivers in the United States, it’s crucial to understand the various exclusions and limitations that may exist within the policy. These exclusions and limitations can impact the coverage provided and may affect how claims are handled in certain situations.

Common Exclusions and Limitations

- Some common exclusions in full coverage auto insurance policies include wear and tear, intentional damage, and racing.

- Limits on coverage may apply to specific situations such as driving under the influence or using the vehicle for commercial purposes.

Navigating Exclusions and Limitations

- New drivers should carefully review their policy documents to understand what is excluded or limited in their coverage.

- Consider adding additional coverage options to fill gaps left by exclusions or limitations in the policy.

Examples of Exclusions and Limitations

- If a new driver gets into an accident while driving under the influence, their insurance policy may exclude coverage for damages.

- Limited coverage may apply to rental cars or vehicles used for ridesharing services.

Comparison with Other Types of Coverage

- Full coverage auto insurance typically offers more comprehensive protection compared to liability-only or comprehensive coverage.

- While liability-only coverage protects against damages to others, full coverage extends to the insured driver and their vehicle.

Filing a Claim and Appealing Decisions

- When an exclusion or limitation affects coverage, policyholders should follow the standard claims process Artikeld in their policy.

- If a claim is denied due to an exclusion, policyholders have the right to appeal the decision with their insurance company.

Impact of Age, Gender, and Marital Status on Full Coverage Auto Insurance

When it comes to determining insurance rates for new drivers, factors like age, gender, and marital status can play a significant role in influencing the cost of full coverage auto insurance. Insurance companies consider these demographics as indicators of risk and use them to assess the likelihood of a driver being involved in accidents or filing claims.Age is a crucial factor in insurance pricing, as statistics show that younger drivers, especially teenagers, are more prone to accidents due to their lack of driving experience.

As a result, insurance premiums tend to be higher for younger drivers compared to older, more experienced drivers.Gender has also historically been a factor in insurance pricing, with statistics suggesting that male drivers are more likely to be involved in accidents than female drivers.

However, some states have enacted laws prohibiting the use of gender as a determining factor in insurance rates to prevent discrimination.Marital status is another factor that insurance companies consider when calculating premiums. Married individuals tend to receive lower insurance rates compared to single individuals, as studies have shown that married drivers are less likely to engage in risky driving behaviors.

Regulations on Discrimination in Insurance Pricing

Insurance companies are subject to regulations that prohibit discrimination based on age, gender, and marital status in insurance pricing. The Equal Credit Opportunity Act (ECOA) and the Fair Credit Reporting Act (FCRA) prohibit insurance companies from using these factors as the sole basis for determining insurance rates.

Additionally, some states have specific laws that restrict the use of certain demographics in setting insurance premiums to ensure fairness and prevent discrimination in the insurance industry.

Impact of Age on Insurance Rates

- Younger drivers, especially teenagers, typically face higher insurance premiums due to their lack of driving experience and higher likelihood of accidents.

- Drivers over the age of 25 may see lower insurance rates as they are considered more experienced and less risky.

Gender and Insurance Pricing

- Historically, male drivers have been charged higher premiums than female drivers due to statistical data suggesting higher accident rates among males.

- Some states have implemented regulations to prevent gender discrimination in insurance pricing.

Marital Status and Insurance Rates

- Married individuals are often offered lower insurance rates compared to single individuals, as studies indicate that married drivers are less likely to be involved in accidents.

- Insurance companies may view married drivers as more responsible and less prone to risky driving behaviors.

Future Trends in Full Coverage Auto Insurance for New Drivers

As the insurance industry continues to evolve, it is essential to consider how full coverage auto insurance for new drivers may change in the future. Emerging trends in technology, regulations, and consumer behavior can significantly impact the coverage options available to new drivers.

Integration of Telematics and Usage-Based Insurance

With advancements in technology, insurance companies are increasingly utilizing telematics devices to track driver behavior and offer usage-based insurance policies. This trend is likely to continue, providing new drivers with the opportunity to demonstrate safe driving habits and potentially lower their insurance premiums based on actual driving data.

- Telematics devices monitor factors such as speed, braking, and acceleration to assess driver risk.

- Usage-based insurance policies can incentivize safe driving practices and lead to personalized coverage options for new drivers.

Rise of Autonomous Vehicles and Insurance Adjustments

The introduction of autonomous vehicles into the market may reshape the landscape of auto insurance, including coverage for new drivers. As self-driving cars become more prevalent, insurance providers will need to adapt their policies to address the unique risks and liabilities associated with this emerging technology.

Insurance companies may need to redefine traditional coverage models to account for automated driving systems and determine liability in accidents involving autonomous vehicles.

Are you familiar with auto insurance liability coverage in the United States? If not, you’re in luck! Learn all about it in our latest article on Auto insurance liability coverage in United States. Understanding this type of coverage is crucial for protecting yourself and your assets in case of an accident.

Personalized and On-Demand Insurance Solutions

In response to changing consumer preferences, insurance companies are exploring personalized and on-demand insurance solutions that cater to individual needs and usage patterns. This shift towards flexibility and customization could benefit new drivers by offering them more control over their coverage and pricing.

- On-demand insurance allows drivers to purchase coverage for specific periods or activities, such as borrowing a friend’s car or taking a road trip.

- Personalized insurance options consider factors like driving experience, location, and vehicle type to tailor coverage to the driver’s unique profile.

Final Review

So there you have it, a comprehensive guide to full coverage auto insurance for new drivers in the United States. Remember to drive safely and insured!

FAQs

What does full coverage auto insurance for new drivers include?

Full coverage typically includes liability, collision, and comprehensive coverage, offering extensive protection for new drivers.

How can new drivers save on insurance premiums?

New drivers can save by maintaining good grades, taking a defensive driving course, and comparing quotes for the best rates.

Which insurance companies are known for affordable full coverage for new drivers?

Some top insurance companies known for providing affordable full coverage to new drivers include XYZ Insurance and ABC Insurance.