Auto insurance liability coverage in united states – Auto insurance liability coverage in the United States opens a world of protection and legal requirements that every driver should understand. Let’s dive into the complexities and nuances of this crucial aspect of insurance.

Overview of Auto Insurance Liability Coverage in the United States

Auto insurance liability coverage is a type of insurance that helps cover the costs of injuries or property damage that you are legally responsible for in an auto accident. It is a mandatory requirement in most states in the United States to have liability coverage to drive legally on the roads.

Importance of Having Liability Coverage

Having liability coverage is important as it helps protect you financially in case you are at fault in an accident. Without liability coverage, you could be personally responsible for paying for the damages, medical bills, and legal fees that may arise from an accident.

Legal Requirements for Auto Insurance Liability Coverage

In the United States, each state has its own minimum requirements for liability coverage that drivers must carry. These requirements typically include both bodily injury liability and property damage liability coverage.

Examples of Situations Where Liability Coverage Would Come into Play

- If you cause an accident that results in injuries to another person.

- If you damage someone else’s property, such as their vehicle or home, in a car accident.

Comparison with Other Types of Auto Insurance Coverage

Liability coverage differs from other types of auto insurance coverage, such as collision or comprehensive coverage, as it specifically covers damages and injuries you cause to others in an accident, rather than covering your own vehicle.

Components of Liability Coverage

Bodily Injury Liability

Covers medical expenses, lost wages, and other costs for injuries to other people in an accident you are at fault for.

Property Damage Liability

Covers the cost of repairing or replacing property that you damage in an accident.

Factors Affecting the Cost of Liability Coverage

The cost of liability coverage can be affected by factors such as your driving record, age, location, and the amount of coverage you choose. Drivers with a history of accidents or traffic violations may pay higher premiums.

Determining the Appropriate Amount of Liability Coverage

It is important to consider factors such as your assets, income, and potential risks when determining the appropriate amount of liability coverage. It is recommended to carry coverage limits higher than the state minimums to protect yourself financially.

Filing a Liability Claim and Consequences of Driving Without Proper Coverage

When filing a liability claim, you will need to provide information about the accident, such as the parties involved and the damages incurred. Driving without proper liability coverage can result in fines, license suspension, and legal consequences.

Types of Auto Insurance Liability Coverage: Auto Insurance Liability Coverage In United States

When it comes to auto insurance liability coverage in the United States, there are two main types: bodily injury liability and property damage liability. Let’s take a closer look at each type and their coverage limits.

Bodily Injury Liability

Bodily injury liability coverage helps pay for medical expenses, lost wages, and legal fees if you are found responsible for injuring someone in a car accident. This coverage also extends to injuries caused by you while driving someone else’s car with their permission.

The coverage limits for bodily injury liability are typically expressed as split limits, such as 25/50/25. This means the policy will pay up to $25,000 per person for bodily injury, up to a maximum of $50,000 per accident, and up to $25,000 for property damage.

Property Damage Liability

Property damage liability coverage helps pay for damage to another person’s vehicle or property if you are at fault in an accident. This coverage does not apply to damage to your own vehicle. Similar to bodily injury liability, property damage liability coverage also comes with coverage limits.

For example, a policy with coverage limits of 50/100/50 would pay up to $50,000 for property damage caused by the policyholder, with a maximum of $100,000 per accident.In scenarios where bodily injury liability coverage would come into play, imagine you’re at fault in an accident where the other driver sustains serious injuries and requires extensive medical treatment.

Your bodily injury liability coverage would help cover their medical expenses and any lost wages. On the other hand, property damage liability coverage would be essential if you accidentally crash into someone’s fence or damage their vehicle in a collision, helping to pay for the repairs or replacement costs.

Minimum Coverage Requirements by State

In the United States, each state sets its own minimum requirements for auto insurance liability coverage. These requirements dictate the minimum amount of coverage a driver must carry to legally operate a vehicle in that state.

States with the Highest and Lowest Minimum Liability Coverage Requirements

Different states have varying minimum liability coverage requirements. For example, states like Alaska, Maine, and New Hampshire have relatively high minimum coverage requirements compared to states like Florida, Mississippi, and New Mexico, which have lower minimum requirements.

How States Determine Their Minimum Coverage Requirements

States determine their minimum coverage requirements based on factors such as population density, accident rates, and overall cost of living. These requirements are often updated to reflect changing economic conditions and insurance industry standards.

Implications of Driving in a State with Low Minimum Coverage Requirements

Driving in a state with low minimum coverage requirements can leave drivers financially vulnerable in case of an accident. In such states, drivers may be personally liable for any costs exceeding the minimum coverage, potentially leading to financial hardship.

Comparison of Minimum Liability Coverage Requirements

| State | Minimum Coverage Requirements |

|---|---|

| Alaska | $50,000/$100,000/$25,000 |

| Florida | $10,000/$20,000/$10,000 |

| New Hampshire | 25/50/25 |

| Mississippi | $25,000/$50,000/$25,000 |

| New Mexico | $25,000/$50,000/$10,000 |

Situations Where Minimum Coverage May Not Be Enough

Having only minimum coverage may not be enough to cover potential costs in situations where severe injuries or extensive property damage occur. In such cases, drivers with minimum coverage may face lawsuits or personal financial liability to cover the excess costs.

Penalties for Driving without Meeting Minimum Coverage Requirements

Driving without meeting the minimum coverage requirements in a state can result in penalties such as fines, license suspension, vehicle impoundment, or even legal action. It is crucial for drivers to ensure they meet the minimum coverage requirements to avoid these consequences.

Factors Influencing Auto Insurance Liability Rates

When it comes to auto insurance liability rates in the United States, there are several factors that can influence how much you pay for coverage. Understanding these factors can help you make informed decisions and potentially lower your insurance costs.Age, Gender, Driving Record, and Location are some of the key factors that play a significant role in determining auto insurance liability rates.

Let’s explore how each of these factors impacts your rates and discuss strategies to potentially reduce your costs.

Age

Age is a crucial factor in determining auto insurance liability rates. Younger drivers, especially teenagers, tend to face higher premiums due to their lack of driving experience and higher likelihood of being involved in accidents. On the other hand, older drivers, typically over the age of 25, may benefit from lower rates as they are considered more experienced and safer on the road.

Gender

Gender can also impact auto insurance liability rates, with statistics showing that male drivers are more likely to be involved in accidents compared to female drivers. As a result, male drivers often face higher premiums. However, it’s important to note that some states have banned the use of gender as a rating factor, aiming for more gender-neutral pricing.

Driving Record

Your driving record is one of the most significant factors that influence auto insurance liability rates. A clean driving record with no accidents or traffic violations can result in lower premiums, as it demonstrates to insurance companies that you are a safe and responsible driver.

On the other hand, a history of accidents or traffic violations can lead to higher rates.

Location

Where you live can also impact your auto insurance liability rates. Urban areas with higher population density and more traffic congestion tend to have higher rates due to increased risk of accidents. Additionally, areas prone to severe weather conditions or high crime rates may also result in higher premiums.

By understanding these factors and taking proactive steps such as maintaining a clean driving record, completing a defensive driving course, or bundling your auto insurance with other policies, you may be able to lower your auto insurance liability rates and save on your overall insurance costs.

Uninsured and Underinsured Motorist Coverage

Uninsured and underinsured motorist coverage is an essential component of auto insurance that protects you in case you are involved in an accident with a driver who does not have insurance or whose insurance is insufficient to cover the damages.

Importance of Uninsured and Underinsured Motorist Coverage

Uninsured and underinsured motorist coverage is crucial because it provides financial protection for you and your passengers in the event of an accident caused by an uninsured or underinsured driver. Without this coverage, you may be left with hefty out-of-pocket expenses for medical bills, vehicle repairs, and other damages.

Scenarios where this coverage is necessary

- Hit-and-run accidents where the at-fault driver cannot be identified

- Accidents with uninsured drivers

- Accidents with underinsured drivers whose coverage limits are insufficient to cover all damages

Benefits of adding this coverage to a policy

By adding uninsured and underinsured motorist coverage to your policy, you can ensure that you are protected in situations where the other driver is unable to cover the costs of an accident. This coverage can help you avoid financial hardship and ensure that you receive the necessary compensation for injuries and damages.

Coverage Limits and Deductibles

When it comes to auto insurance liability coverage, coverage limits and deductibles play a crucial role in determining the extent of protection and the cost of premiums for policyholders. Coverage limits refer to the maximum amount an insurance company will pay out for a covered claim, while deductibles are the amount of money the policyholder must pay out of pocket before the insurance coverage kicks in.

Choosing Coverage Limits

- It is essential to carefully consider your financial situation and assets when selecting coverage limits. Opting for higher coverage limits can provide more protection in the event of a serious accident but may also result in higher premiums.

- State minimum coverage requirements may not be sufficient to cover all potential costs in the event of a severe accident, so it is important to assess your individual needs and risks.

- Factors such as the value of your assets, income level, and risk tolerance should be taken into account when determining appropriate coverage limits.

Understanding Deductibles

- Choosing a higher deductible can help lower your insurance premiums, as you will be responsible for paying more out of pocket in the event of a claim.

- Conversely, a lower deductible means you will pay less upfront in the event of a claim, but your premiums are likely to be higher.

- Consider your financial situation and ability to cover the deductible amount when selecting a deductible level.

Coverage Extensions and Add-Ons

When it comes to auto insurance liability coverage, there are additional options available to enhance your protection beyond the basic coverage. These coverage extensions, also known as endorsements or riders, can provide added benefits in specific situations, giving you peace of mind on the road.

Umbrella Liability Coverage

Umbrella liability coverage is a common add-on that extends your liability coverage beyond the limits of your primary auto insurance policy. This coverage kicks in when your primary liability limits are exhausted, providing an extra layer of protection in case of a major accident.

Rental Car Reimbursement

Rental car reimbursement is another useful add-on that covers the cost of a rental car while your vehicle is being repaired after an accident. This can be a lifesaver in situations where you rely on your car for daily activities and cannot afford to be without a vehicle.

Roadside Assistance

Roadside assistance is a valuable add-on that provides services such as towing, battery jump-starts, flat tire changes, and fuel delivery in case of a breakdown. This coverage can come in handy in emergencies, ensuring you get the help you need quickly and efficiently.

Gap Insurance

Gap insurance is a coverage extension that covers the difference between the actual cash value of your vehicle and the amount you owe on a car loan or lease. In the event of a total loss, this coverage ensures you are not left paying off a loan for a car you no longer have.

Medical Payments Coverage

Medical payments coverage is an add-on that covers medical expenses for you and your passengers in the event of an accident, regardless of who is at fault. This coverage can help offset medical bills and expenses not covered by your health insurance.

Accident Forgiveness

Accident forgiveness is a beneficial add-on that prevents your insurance rates from increasing after your first at-fault accident. This can save you money in the long run and protect your premium from significant hikes due to a single mistake on the road.

Filing a Liability Claim

When it comes to filing a liability claim with an insurance company, there are specific steps and guidelines that need to be followed to ensure a smooth process. It is crucial to document the incident accurately and gather all necessary information to support your claim effectively.

Looking for low cost auto insurance in the United States? Check out this helpful guide to find the best deals and savings on auto insurance policies: Low cost auto insurance in united states. Don’t break the bank – get the coverage you need at a price you can afford!

Steps for Filing a Liability Claim

- Notify your insurance company as soon as possible after the incident.

- Provide detailed information about the accident, including date, time, location, and parties involved.

- Document any injuries or property damage resulting from the incident.

- Cooperate with the insurance adjusters and provide any additional information or documentation they may require.

Role of Adjusters

Adjusters play a crucial role in investigating and evaluating liability claims. They assess the damages, review the evidence, and negotiate settlements on behalf of the insurance company.

Required Information for Reporting

- Policyholder’s name and policy number

- Date, time, and location of the incident

- Description of the accident and damages

- Contact information for all parties involved

Supporting Documentation

- Police reports

- Witness statements

- Photographs of the accident scene and damages

- Medical records and bills

Timeline and Communication

It is essential to file a liability claim promptly after the incident, as there may be deadlines set by the insurance company. Throughout the claims process, maintaining open communication with your insurance company is key to a successful resolution.

Outcomes of a Liability Claim

The outcome of a liability claim is determined based on the evidence, extent of damages, and applicable laws. Possible outcomes include settlement agreements, court judgments, or denial of the claim.

Liability Coverage for Rental Cars

When renting a car in the United States, it is important to understand the minimum liability coverage requirements to ensure you are adequately protected in case of an accident. Liability coverage for rental cars can vary between rental car companies and states, so it is crucial to be informed before hitting the road.

Minimum Liability Coverage Requirements for Rental Cars

- Rental car companies typically provide the minimum required liability coverage as mandated by the state in which the car is rented.

- These requirements can vary from state to state, so it is essential to know the specific limits in the state you are renting the car.

Comparison of Liability Coverage in Personal Auto Insurance vs. Rental Car Insurance

- Personal auto insurance policies may offer liability coverage that extends to rental cars, but it is essential to check with your insurance provider to confirm coverage.

- Rental car insurance often provides primary liability coverage for the rental period, which means your personal insurance may not need to be involved in case of an accident.

Importance of Reading Rental Car Insurance Terms and Conditions, Auto insurance liability coverage in united states

- It is crucial to read the terms and conditions of rental car insurance to understand the extent of liability coverage provided.

- Knowing what is covered and what is not can prevent surprises in the event of an accident.

Steps to Take If Rental Car Liability Coverage Is Insufficient

- If you feel that the liability coverage offered by the rental car company is insufficient, consider purchasing additional coverage from the rental company or a third-party provider.

- Using a credit card that offers rental car insurance can also provide additional coverage in case the rental car insurance falls short.

Liability Coverage for Teenage Drivers

Teenage drivers pose unique challenges when it comes to obtaining liability coverage. Insurance companies view them as higher risk due to their lack of driving experience and higher likelihood of accidents.Adding a teenage driver to a policy can significantly affect premiums, leading to an increase in the overall cost of insurance.

This is because insurance companies consider teenage drivers to be more prone to accidents, which can result in higher claims payouts.

Managing Liability Coverage for Teenage Drivers

- Consider enrolling the teenage driver in a defensive driving course to improve their skills and demonstrate responsibility.

- Explore options for good student discounts, as maintaining good grades can sometimes lead to lower premiums.

- Encourage safe driving habits and set clear guidelines for the teenage driver to follow while behind the wheel.

- Review the policy regularly and consider adjusting coverage limits or deductibles based on the teenager’s driving record and behavior.

Liability Coverage in At-Fault vs. No-Fault States

In the United States, auto insurance liability coverage can vary depending on whether you live in an at-fault or no-fault state. Understanding the differences in minimum coverage requirements and fault determination is crucial for drivers to navigate the insurance claims process effectively.

Minimum Liability Coverage Requirements

In at-fault states, drivers are typically required to have liability coverage that includes bodily injury and property damage liability. The minimum coverage limits can vary by state but generally range from $25,000 to $50,000 for bodily injury per person, $50,000 to $100,000 for bodily injury per accident, and $25,000 to $50,000 for property damage.

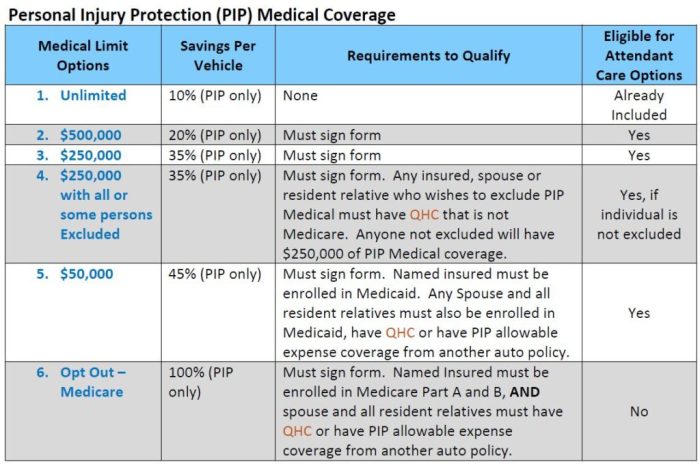

On the other hand, no-fault states have different requirements that focus on personal injury protection (PIP) coverage, which helps cover medical expenses and lost wages regardless of who is at fault in an accident.

Role of Fault Determination in Liability Claims

In at-fault states, fault determination plays a significant role in auto insurance liability claims. The driver found at fault in an accident is responsible for covering the damages of the other party, up to the policy limits. Conversely, in no-fault states, each driver’s insurance company pays for their own medical expenses and other damages regardless of fault, which can streamline the claims process but may limit the ability to seek compensation from the at-fault party.

Impact on Filing Liability Claims

Living in an at-fault or no-fault state can impact how drivers file liability claims with their insurance companies. In at-fault states, drivers may need to provide evidence of fault, such as police reports or witness statements, to support their claims.

In contrast, drivers in no-fault states typically file claims with their own insurance company, which handles the compensation process regardless of fault.

Examples of At-Fault and No-Fault States

Examples of at-fault states include California, Texas, and Florida, where drivers must prove fault to recover damages in an accident. On the other hand, states like Michigan, New York, and Florida operate under a no-fault system, where drivers rely on their own insurance for coverage regardless of fault.

These examples highlight the diverse approaches to liability coverage across different states in the U.S.

Impact of Credit Score on Liability Coverage

Credit scores play a significant role in determining auto insurance liability rates for individuals in the United States. Let’s delve into the specific factors within credit scores that can influence these rates and how you can navigate this aspect of insurance coverage.

Factors Influencing Credit Score Impact on Liability Coverage

- Credit History: A solid credit history indicates financial responsibility, leading to lower insurance premiums.

- Credit Utilization: High credit card balances relative to credit limits can negatively impact your credit score and, in turn, your insurance rates.

- Payment History: Timely payments on loans and credit cards demonstrate reliability, potentially resulting in lower liability coverage costs.

- Credit Inquiries: Multiple credit inquiries can signal financial instability, affecting your credit score and insurance rates.

Case Studies and Research on Credit Score Impact

Research has shown that individuals with poor credit scores can pay up to 50% more for auto insurance liability coverage compared to those with excellent credit.

- A study by the Federal Trade Commission found a direct correlation between lower credit scores and higher insurance premiums.

- Case studies have highlighted instances where improving credit scores led to significant reductions in liability coverage costs for policyholders.

Regulations and Guidelines on Credit Score Use

- Some states have regulations limiting the use of credit scores in determining insurance rates to ensure fairness and prevent discrimination.

- The Fair Credit Reporting Act provides guidelines on how credit information can be used by insurers in setting premiums.

Checking Credit Scores and Understanding Implications

- Individuals can access their credit reports for free once a year from major credit bureaus like Equifax, Experian, and TransUnion.

- Understanding the components of a credit score, such as payment history and credit utilization, can help individuals assess their insurance premium implications.

Comparison of Liability Coverage Rates based on Credit Scores

On average, a driver with a poor credit score can pay double the premium of a driver with an excellent credit score for the same liability coverage.

- Insurance companies often categorize individuals into different risk groups based on credit scores, leading to varying premium rates.

- Comparing quotes from insurers based on different credit score scenarios can provide insights into the financial impact of credit on liability coverage.

Coverage for Medical Payments

Medical payments coverage in auto insurance liability plays a crucial role in providing financial protection for medical expenses resulting from a car accident, irrespective of fault.

Benefits of Medical Payments Coverage

Medical payments coverage offers several benefits in addition to liability coverage, such as:

- Immediate coverage for medical expenses: Medical payments coverage can help pay for medical bills promptly, regardless of who is at fault in the accident.

- Additional coverage for injuries: It can provide extra protection for injuries sustained by you and your passengers in a car accident.

- Peace of mind: Having medical payments coverage can offer peace of mind knowing that medical expenses are covered, reducing financial stress during a challenging time.

Examples of Situations where Medical Payments Coverage is Beneficial

Medical payments coverage can be beneficial in various scenarios, including:

- Emergency room visits and hospital stays

- Physical therapy and rehabilitation

- Doctor visits and medical consultations

- Pain management treatments

- Dental care resulting from an accident

Liability Coverage for Uber and Lyft Drivers

When it comes to rideshare drivers working for companies like Uber and Lyft, the need for adequate liability coverage becomes crucial. Personal auto insurance may not fully cover accidents that occur while driving for these services, leaving drivers exposed to significant financial risks.

Unique Liability Coverage Needs of Rideshare Drivers

Rideshare drivers operate in a unique environment where they are constantly ferrying passengers for a fee. This commercial use of their vehicles may not be covered under personal auto insurance policies, necessitating the need for specialized rideshare insurance.

- Rideshare insurance: Commercial rideshare insurance offers coverage specifically tailored to the needs of drivers working for companies like Uber and Lyft. It provides protection in case of accidents while transporting passengers or driving for business purposes.

- Personal auto insurance: On the other hand, personal auto insurance policies typically exclude coverage for commercial activities. This means that if an accident occurs while a driver is working for a rideshare company, their personal policy may not cover the damages.

Comparing Commercial Rideshare Insurance and Personal Auto Insurance

A detailed comparison of commercial rideshare insurance and personal auto insurance is essential for rideshare drivers to understand the differences in coverage limits and exclusions.

| Aspect | Commercial Rideshare Insurance | Personal Auto Insurance |

|---|---|---|

| Coverage | Provides specific coverage for rideshare activities | Excludes coverage for commercial use |

| Limits | Higher coverage limits for liability and property damage | Limited coverage for business activities |

| Exclusions | Includes coverage for accidents during ridesharing | Excludes coverage for commercial use of the vehicle |

Assessing Insurance Coverage as a Rideshare Driver

Rideshare drivers should conduct a thorough assessment of their current insurance coverage to determine if additional coverage is needed to protect themselves and their passengers.

- Review existing policies: Check the terms and conditions of personal auto insurance to understand any limitations related to ridesharing activities.

- Consult with insurers: Speak to insurance providers to inquire about rideshare-specific coverage options and ensure all potential scenarios are covered.

- Consider additional coverage: Evaluate the need for additional rideshare insurance to fill any gaps in coverage and mitigate financial risks.

Real-Life Scenarios of Inadequate Liability Coverage

Without proper liability coverage, rideshare drivers may face severe legal and financial consequences in the event of accidents. Real-life examples highlight the importance of securing adequate insurance to protect both drivers and passengers.

For instance, a rideshare driver involved in a collision while transporting passengers could be held personally liable for damages if their insurance does not cover commercial activities.

Liability Coverage for Commercial Vehicles

Commercial vehicles require a different type of liability coverage compared to personal vehicles due to the increased risks associated with their operations. It is crucial for businesses to have appropriate coverage to protect themselves financially in case of accidents.

Are you looking for low cost auto insurance in the United States? Look no further! Check out this helpful guide on Low cost auto insurance in United States to find the best deals and save money on your car insurance today!

Differences in Liability Coverage

- Commercial vehicles often carry higher liability limits to cover potential damages from accidents involving larger vehicles or transporting valuable cargo.

- Personal vehicles typically have lower liability limits since they are not used for business purposes and carry less risk.

Additional Risks for Commercial Vehicles

- Commercial vehicles are often on the road for longer periods, increasing the likelihood of accidents.

- Transporting goods or passengers can expose commercial vehicles to more potential hazards and liability claims.

Importance of Appropriate Coverage

- Having adequate liability coverage for commercial vehicles can protect businesses from financial ruin in the event of a costly accident.

- Failure to have proper coverage can result in legal penalties and potential lawsuits that can severely impact a business’s operations.

Comparison of Liability Limits

- Personal vehicles typically have lower liability limits, often starting at the state minimum requirements.

- Commercial vehicles may require significantly higher liability limits to ensure adequate coverage for potential damages and legal expenses.

Types of Commercial Vehicles Requiring Specialized Coverage

- Trucks, vans, buses, and other commercial vehicles often require specialized liability coverage due to their size, weight, and specific usage.

- These vehicles may have unique risks that standard personal auto policies do not adequately cover.

Determining the Right Amount of Coverage

- Business owners should consider the size, usage, and cargo of their commercial vehicles when determining the appropriate liability coverage limits.

- An insurance agent can help assess the risks and recommend suitable coverage based on the specific needs of the business.

Legal Implications of Inadequate Coverage

- Operating commercial vehicles without sufficient liability coverage can lead to fines, license suspension, and potential legal action against the business owner.

- Business owners have a legal responsibility to ensure their vehicles are adequately insured to protect others on the road.

Recommendations for Insurance Providers

- Reputable insurance providers that specialize in commercial vehicle coverage can offer comprehensive policies tailored to the specific needs of businesses.

- It is essential for business owners to research and compare insurance providers to find the best coverage options and rates for their commercial vehicles.

Epilogue

From understanding coverage limits to exploring the impact of credit scores, Auto insurance liability coverage in the United States is a multifaceted topic that demands attention and knowledge for every driver on the road.

Expert Answers

Is liability coverage mandatory in all states?

Yes, most states require drivers to have at least a minimum amount of liability coverage.

How does location affect liability coverage rates?

Location plays a significant role in determining insurance rates, with urban areas generally having higher rates due to increased traffic and crime rates.

Can I adjust my coverage limits after purchasing a policy?

Yes, you can typically adjust your coverage limits at any time by contacting your insurance provider.