Low cost auto insurance in United States opens the door to affordable coverage options that can save you money without compromising quality. Get ready for a journey filled with tips, tricks, and insights to help you secure the best deal on your auto insurance.

Overview of Low-Cost Auto Insurance

Low-cost auto insurance refers to insurance policies that are available at a more affordable rate compared to standard insurance options. These policies are designed to provide basic coverage while keeping premiums relatively low.

It is important to find affordable coverage to ensure that you meet the legal requirements for auto insurance in your state without breaking the bank. Low-cost insurance can help you comply with the law while also protecting you financially in case of an accident.

Differences from Standard Insurance

- Low-cost auto insurance typically offers minimal coverage, focusing on meeting the legal requirements without additional frills or extras.

- Standard insurance policies often provide more comprehensive coverage, including options for higher liability limits, additional protection for your vehicle, and other features.

- While low-cost insurance can be a budget-friendly option, it may come with limitations or restrictions that could impact your coverage in certain situations.

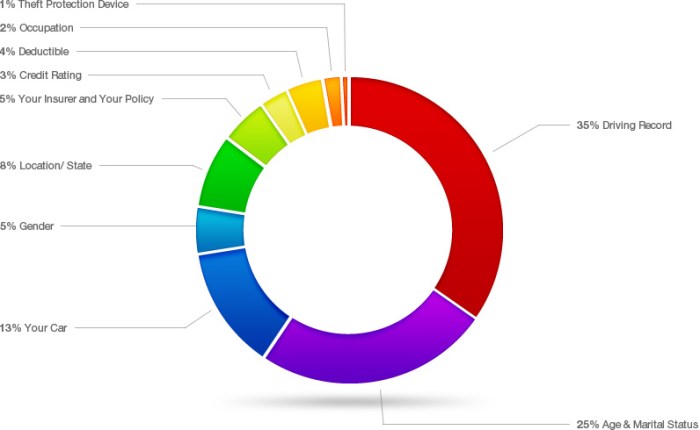

Factors Influencing Auto Insurance Costs

When it comes to determining auto insurance premiums, there are several factors that play a significant role in influencing the cost. Let’s take a closer look at some of the key factors that insurance companies consider when setting rates.

Demographics Impact on Insurance Rates

Demographic factors such as age and location can have a major impact on auto insurance rates. Younger drivers, especially teenagers, are often charged higher premiums due to their lack of driving experience and higher likelihood of being involved in accidents.

Additionally, urban areas tend to have higher rates compared to rural areas due to increased traffic congestion and higher rates of theft and vandalism.

Vehicle Type and Driving Record

The type of vehicle you drive and your driving record also play a crucial role in determining insurance costs. For example, sports cars and luxury vehicles typically have higher insurance premiums due to their higher repair costs and increased risk of theft.

On the other hand, drivers with a clean driving record are usually rewarded with lower premiums, while those with a history of accidents or traffic violations may face higher rates.

Impact of Driver’s Age Group on Premiums

To illustrate how a driver’s age group can influence insurance premiums, consider the following scenario: a 25-year-old driver is likely to pay less for insurance compared to a 18-year-old driver, as the older driver is perceived as less risky and more experienced behind the wheel.

Comparison of Insurance Rates by Location

Insurance rates can vary significantly based on location. For instance, a driver living in a densely populated urban area like New York City is likely to pay more for insurance compared to a driver residing in a rural town in Iowa.

This discrepancy is due to factors such as crime rates, traffic congestion, and frequency of accidents in different locations.

Are you looking for the best car insurance in the United States? Look no further! Check out this comprehensive guide to finding the best car insurance in the United States that suits your needs and budget. Don’t miss out on great coverage and affordable rates!

Impact of Vehicle Make and Model on Insurance Costs

The make and model of a vehicle can greatly impact insurance costs. For example, a brand new luxury SUV will typically have higher insurance premiums compared to a used sedan, as the SUV’s repair costs are higher. Insurance companies also take into account the vehicle’s safety features, theft rates, and overall cost of repairs when calculating premiums.

Driving Record and Insurance Premiums

Having a clean driving record can lead to lower insurance premiums, as it demonstrates responsible and safe driving habits. On the other hand, a driving record with accidents or traffic violations can result in higher insurance costs, as it indicates a higher risk of future claims.

State-by-State Comparison of Auto Insurance Rates

When it comes to auto insurance rates, various factors come into play, including state regulations, demographic information, and insurance providers. Let’s delve into a detailed breakdown of how these factors influence auto insurance rates across different states.

Factors Influencing Auto Insurance Rates in Each State

- State regulations on insurance coverage requirements

- Density of population and traffic congestion

- Incidence of vehicle theft and accidents

- Local weather conditions affecting road safety

Minimum Coverage Requirements for Auto Insurance Across Different States

- California requires a minimum liability coverage of $15,000 for injury/death to one person, $30,000 for injury/death to more than one person, and $5,000 for property damage.

- Texas mandates a minimum liability coverage of $30,000 per person for bodily injury, $60,000 per accident, and $25,000 for property damage.

Impact of Demographics on Insurance Rates

- Young drivers typically pay higher premiums due to their lack of driving experience.

- Married individuals tend to receive lower insurance rates compared to single drivers.

Top Insurance Providers and Pricing Strategies in Each State

- State Farm, Geico, and Progressive are among the top insurance providers in most states.

- Insurance companies may offer discounts for bundling policies or maintaining a good driving record.

Average Cost of Coverage in Urban vs. Rural Areas

- Urban areas generally have higher insurance rates due to increased traffic and higher accident rates.

- Rural areas may have lower premiums but limited coverage options.

State-Specific Grants or Subsidies for Drivers

- Some states offer subsidies for low-income drivers to help reduce insurance costs.

- Grants may be available for certain demographic groups or individuals with clean driving records.

Impact of Traffic Violations and Accidents on Insurance Premiums

- Drivers with a history of traffic violations or accidents may see significant increases in their insurance premiums.

- Insurance rates can vary based on the severity and frequency of violations or accidents.

Obtaining Quotes for State-by-State Comparison

- Research multiple insurance companies and request quotes based on your specific coverage needs.

- Compare rates, coverage options, and customer reviews to make an informed decision.

Strategies for Finding Affordable Auto Insurance: Low Cost Auto Insurance In United States

Finding affordable auto insurance is crucial for many individuals looking to save money while still maintaining necessary coverage. By implementing certain strategies and understanding key factors that influence insurance costs, you can lower your premiums and find a policy that fits your budget.

Tips for Lowering Insurance Premiums

- Drive safely and maintain a clean driving record to qualify for safe driver discounts.

- Consider opting for a higher deductible, which can lower your monthly premiums.

- Take advantage of multi-policy discounts by bundling your home and auto insurance with the same provider.

- Shop around and compare quotes from multiple insurance companies to find the best rate.

- Inquire about any available discounts, such as for low mileage or safety features on your vehicle.

Benefits of Bundling Home and Auto Insurance Policies

Bundling your home and auto insurance policies with the same provider can lead to significant savings on your premiums. Insurance companies often offer discounts for customers who purchase multiple policies, making it a cost-effective option for those looking to reduce their overall insurance expenses.

Raising Deductibles to Reduce Insurance Costs

Increasing your deductible amount can result in lower insurance costs since you assume more financial responsibility in the event of a claim. However, it’s important to ensure that you can afford the higher deductible amount out of pocket if needed.

Factors Considered by Insurance Companies for Premium Determination

- Driving record and history of accidents

- Type of vehicle and its safety features

- Age, gender, and marital status of the driver

- Location and area of residence

- Credit score and financial stability

Obtaining Quotes from Multiple Insurance Providers

When seeking affordable auto insurance, it’s essential to request quotes from various insurance providers to compare rates and coverage options. By exploring different offers, you can find the most competitive price that meets your needs.

Optional Coverage to Exclude for Cost Reduction

- Rental car reimbursement coverage

- Roadside assistance coverage

- Comprehensive and collision coverage for older vehicles

Understanding Coverage Options for Low-Cost Auto Insurance

When it comes to low-cost auto insurance, understanding the different coverage options available is crucial. Let’s explore the types of coverage, minimum requirements in various states, and optional add-ons for extra protection.

Types of Coverage in Low-Cost Insurance Plans

- Bodily Injury Liability: Covers medical expenses for injuries caused to others in an accident you are responsible for.

- Property Damage Liability: Pays for damages to another person’s property caused by your vehicle.

- Personal Injury Protection (PIP): Covers medical expenses and lost wages for you and your passengers, regardless of fault.

Minimum Coverage Requirements in Various States

- California: 15/30/5 (in thousands) for bodily injury per person, bodily injury per accident, and property damage liability.

- Texas: 30/60/25 for bodily injury per person, bodily injury per accident, and property damage liability.

- Florida: 10/20/10 for bodily injury per person, bodily injury per accident, and property damage liability.

Optional Coverage for Extra Protection

- Collision Coverage: Pays for damages to your own vehicle in an accident, regardless of fault.

- Comprehensive Coverage: Covers damages to your vehicle from non-collision incidents like theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re in an accident with a driver who has insufficient or no insurance.

Impact of Credit Score on Auto Insurance Rates

Having a good credit score can significantly impact the rates you pay for auto insurance. Insurance companies use credit scores as a factor to determine the level of risk you pose as a policyholder. A higher credit score typically translates to lower insurance premiums, while a lower credit score can result in higher rates.

How Credit Score Affects Auto Insurance Premiums

Insurance companies consider individuals with higher credit scores to be more financially responsible and less likely to file claims. As a result, they offer lower rates to those with good credit. On the other hand, individuals with lower credit scores are seen as higher risk, leading to higher premiums.

- Insurance companies may use credit-based insurance scores, which are different from traditional credit scores but still reflect your creditworthiness.

- Statistically, drivers with poor credit are more likely to file insurance claims, leading to increased premiums.

- States have varying regulations on how credit scores can be used in determining insurance rates.

Strategies for Improving Credit to Lower Insurance Costs

Improving your credit score can help you secure lower auto insurance rates. Here are some strategies to boost your credit:

- Pay your bills on time to establish a positive payment history.

- Keep your credit card balances low and avoid maxing out your credit limit.

- Regularly check your credit report for errors and dispute any inaccuracies.

- Avoid opening multiple new credit accounts in a short period, as this can lower your score.

Examples of How Credit Score Can Impact Insurance Rates

Your credit score can have a significant impact on the amount you pay for auto insurance. Here are some examples of how credit scores can affect insurance rates:

| Credit Score Range | Impact on Insurance Rates |

|---|---|

| Excellent (800+) | May receive the lowest insurance premiums. |

| Good (700-799) | Likely to get competitive rates with some room for improvement. |

| Fair (600-699) | Could see higher premiums compared to those with good credit. |

| Poor (Below 600) | May face significantly higher insurance costs due to credit score. |

Comparison of Online Auto Insurance Quotes

When looking for low-cost auto insurance, comparing online quotes from different insurance companies is crucial in finding the best deal. It allows you to explore various options and choose the one that fits your budget and coverage needs.

Importance of Reviewing Coverage Details, Low cost auto insurance in united states

- Before comparing quotes, make sure to review the coverage details offered by each insurance company.

- Check for the type of coverage included, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Understanding the coverage details will help you make an informed decision and avoid any surprises in the event of an accident.

Using Online Tools to Find the Best Options

- Utilize online tools and comparison websites to gather quotes from multiple insurance companies in one place.

- Enter your information accurately to receive personalized quotes based on your driving history and insurance needs.

- Compare the quotes side by side, taking into consideration not only the price but also the coverage and additional benefits offered by each insurer.

- Look for discounts and incentives that can help lower the cost of your auto insurance policy.

Special Programs and Discounts for Affordable Auto Insurance

When it comes to finding affordable auto insurance, taking advantage of special programs and discounts can make a significant difference in lowering your premiums. These programs and discounts are designed to reward specific behaviors or characteristics that insurance companies consider lower risk.

Pay-As-You-Drive or Usage-Based Insurance

Usage-based insurance programs monitor your driving habits using telematics devices or smartphone apps. By tracking factors like mileage, speed, and braking patterns, insurance companies can offer personalized rates based on your actual driving behavior.

Discounts for Students, Seniors, and Safe Drivers

Insurance companies often provide discounts for students with good grades, seniors who have completed a defensive driving course, and safe drivers with a clean driving record. These discounts reflect the lower risk associated with these demographics.

Affiliation Discounts with Organizations

Being a member of certain organizations, such as alumni associations or professional groups, can qualify you for lower insurance rates. Insurance companies may offer group discounts to members of these organizations as a way to attract more customers.

Bundling Home and Auto Insurance Policies

Combining your home and auto insurance policies with the same company can result in significant savings through a multi-policy discount. Insurers often incentivize bundling by offering reduced rates for customers who purchase multiple policies.

Multi-Vehicle Discounts

If you have more than one vehicle, you can save money by bundling them under the same insurance policy. Insurers typically offer discounts for insuring multiple vehicles, making it a cost-effective option for households with multiple cars.

Defensive Driving Course Benefits

Completing a defensive driving course can not only help you become a safer driver but also qualify you for reduced insurance premiums. Insurance companies view these courses as a proactive step towards safer driving practices, resulting in lower risk for accidents.

Anti-Theft Devices and Discounts

Installing anti-theft devices in your vehicle can deter theft and reduce the risk of vandalism, leading to lower insurance costs. Many insurance companies offer discounts for having anti-theft devices, such as alarms or tracking systems, installed in your car.

Legal Requirements for Auto Insurance in the United States

In the United States, auto insurance is mandatory to protect drivers and ensure financial responsibility in case of accidents. Understanding the legal requirements for auto insurance can help drivers find low-cost options while staying compliant with the law.

Minimum Auto Insurance Requirements

- Each state has its own minimum requirements for auto insurance coverage, typically including liability coverage for bodily injury and property damage.

- For example, in California, drivers must have at least $15,000 in bodily injury coverage per person, $30,000 per accident, and $5,000 in property damage coverage.

Penalties for Driving Without Insurance

- Driving without insurance can result in fines, license suspension, vehicle impoundment, and even legal action.

- Penalties vary by state, but they can be severe, including hefty fines and potential criminal charges.

Importance of Meeting Legal Requirements

- Meeting legal requirements for auto insurance not only keeps you compliant with the law but can also help in finding affordable coverage.

- Insurance companies may offer lower rates to drivers who have the necessary coverage, as they pose less risk of financial liability.

Documents Needed for Compliance

- Drivers may need to provide proof of insurance in the form of an insurance card, policy documents, or electronic proof on a mobile device.

- Other documents, such as vehicle registration and driver’s license, may also be required to prove compliance with auto insurance laws.

Verifying Insurance Coverage During Traffic Stop

- Law enforcement officers can verify insurance coverage electronically during a traffic stop using databases that contain insurance information.

- Drivers may be asked to provide physical proof of insurance if the electronic verification is not available or inconclusive.

Consequences of Driving Without Insurance

- A first offense of driving without insurance may result in fines, license suspension, and the requirement to file an SR-22 form.

- Subsequent offenses can lead to increased fines, longer license suspensions, and even the possibility of jail time in some states.

Risks of Opting for Extremely Low-Cost Auto Insurance

When it comes to choosing auto insurance, opting for an extremely low-cost option may seem like a budget-friendly choice. However, there are significant risks associated with these cheap plans that consumers need to be aware of before making a decision.: Extremely low-cost auto insurance plans often come with coverage limitations that can leave policyholders vulnerable in certain situations.

Understanding these drawbacks is crucial for making an informed decision about the level of protection you need for your vehicle.

Coverage Limitations in Extremely Low-Cost Plans

- Low-cost plans may have high deductibles, meaning that you will have to pay a significant amount out of pocket before your coverage kicks in. This could be financially burdensome in the event of an accident.

- Some cheap insurance options may provide minimal protection for specific scenarios, such as accidents involving uninsured drivers. This could leave you responsible for covering expenses that exceed your policy limits.

Examples of Inadequate Protection

- In cases of severe accidents where medical expenses surpass the policy limits, extremely low-cost insurance may not provide enough coverage, leaving you to cover the remaining costs.

- If your policy excludes coverage for rental cars during repairs after a collision, you may find yourself without a vehicle and facing additional expenses.

Comparison of Customer Support Services

- Low-cost insurance providers may offer limited support services and have a slower claims process compared to mid-range or higher-cost insurers. This can result in delays and frustrations when filing claims or seeking assistance.

- Mid-range or higher-cost insurers often provide better customer experience, with more responsive support teams and easier claims filing processes. This can make a significant difference in how smoothly your insurance coverage operates in times of need.

Impact of Vehicle Safety Features on Insurance Costs

When it comes to auto insurance costs, the safety features of a vehicle play a significant role in determining premiums. Insurance companies consider vehicles with advanced safety features to be less risky, resulting in lower insurance costs for owners.:Vehicles equipped with safety features like airbags, anti-lock brakes, traction control, and anti-theft systems are considered safer on the road.

As a result, insurance companies are more likely to offer lower premiums for these vehicles compared to those without such safety features. Additionally, the presence of these features can help reduce the severity of injuries and damages in case of an accident, further lowering the insurance costs.

Relationship between Vehicle Safety Ratings and Insurance Rates

- Vehicles with high safety ratings from organizations like the Insurance Institute for Highway Safety (IIHS) or the National Highway Traffic Safety Administration (NHTSA) often qualify for lower insurance rates.

- Insurance companies use safety ratings as an indicator of the vehicle’s crashworthiness and overall safety, influencing the premiums offered to owners.

Examples of Vehicles with Features Leading to Lower Insurance Costs

- The Subaru Outback, known for its advanced safety features like EyeSight Driver Assist Technology, often receives lower insurance premiums due to its strong safety record.

- The Honda Civic, equipped with standard safety features such as Honda Sensing, is another example of a vehicle that typically enjoys lower insurance costs.

Role of Insurance Agents in Finding Low-Cost Auto Insurance

Insurance agents play a crucial role in helping individuals find low-cost auto insurance that meets their needs and budget. They have the expertise and knowledge to navigate the complex insurance market and find the best coverage options available.

Benefits of Working with an Agent

- Insurance agents have access to multiple insurance carriers, allowing them to compare prices and coverage options to find the most affordable policy for their clients.

- They can provide personalized advice based on individual circumstances, ensuring that clients get the right amount of coverage without overpaying.

- Agents can help with the claims process, providing support and guidance in case of an accident or other covered event.

Tips for Selecting a Reliable Agent

- Look for an agent who is licensed and experienced in the auto insurance industry.

- Ask for referrals from friends or family members who have had positive experiences with their insurance agents.

- Consider meeting with multiple agents to compare their knowledge, communication style, and willingness to help you find affordable coverage.

- Discuss your budget and coverage needs openly with the agent to ensure they can find a policy that fits your requirements.

Impact of Driving Habits on Auto Insurance Rates

Driving habits play a significant role in determining auto insurance rates. Insurers take into account various factors such as mileage, usage patterns, driving behavior, and vehicle maintenance when calculating premiums. Understanding how driving habits can influence insurance costs is essential for drivers looking to secure affordable coverage.

Benefits of Telematics or Usage-Based Insurance

Telematics or usage-based insurance programs offer benefits for safe drivers. By tracking driving behavior through devices installed in vehicles, insurers can tailor premiums based on actual driving habits. Safe drivers who demonstrate responsible behavior on the road can benefit from lower insurance rates compared to traditional policies.

- Telematics programs reward safe driving practices such as obeying speed limits, avoiding sudden stops, and driving during off-peak hours.

- Drivers can actively monitor their driving habits and make adjustments to improve their behavior, leading to potential cost savings on insurance premiums.

Impact of Driving Violations and Accidents on Premium Rates

Driving violations and accidents have a direct impact on insurance premiums. Drivers with a history of traffic violations or at-fault accidents are considered higher risk by insurers, leading to higher premium rates. It is crucial for drivers to maintain a clean driving record to keep insurance costs affordable.

- Each traffic violation or accident on a driver’s record can result in an increase in insurance premiums due to the elevated risk associated with these incidents.

- Drivers who accumulate multiple violations or accidents may face significantly higher insurance costs or even difficulty in finding coverage.

Factors Affecting Insurance Rates

Various factors related to driving habits can affect insurance rates, including driving frequency, time of day, and vehicle maintenance.

- Regularly driving long distances or during peak traffic hours can increase the likelihood of accidents, leading to higher insurance premiums.

- Proper vehicle maintenance, such as regular servicing and upkeep of safety features, can help reduce the risk of accidents and potential insurance claims, resulting in lower insurance costs.

Comparison of Traditional vs. Pay-As-You-Drive Insurance

Traditional insurance policies typically rely on fixed premiums based on factors like age, location, and driving history. In contrast, pay-as-you-drive options calculate premiums based on actual mileage and driving behavior, offering potential cost savings for low-mileage drivers.

- Pay-as-you-drive insurance allows drivers to pay for the exact amount of coverage they need, making it a more affordable option for those who drive less frequently.

- Drivers who opt for pay-as-you-drive insurance can benefit from personalized rates that reflect their specific driving habits, leading to potential savings on premiums.

Importance of Regularly Reviewing Auto Insurance Policies

Regularly reviewing your auto insurance policy is crucial to ensure you have the coverage you need at the best possible price. Life changes, such as getting married, buying a new car, or moving to a new location, can impact your insurance needs and costs.

By reviewing your policy annually, you can make sure you are still getting the best low-cost auto insurance deal available.

Are you looking for the best car insurance in United States? Look no further! Check out this comprehensive guide to the best car insurance in United States and make sure you’re getting the coverage you need at the best price possible.

Don’t settle for anything less than the best when it comes to protecting your vehicle!

Benefits of Comprehensive Coverage

- Comprehensive coverage provides protection for a wide range of incidents, including theft, vandalism, and natural disasters.

- It offers peace of mind knowing that your vehicle is covered in various scenarios, not just accidents.

- Comprehensive coverage can be especially valuable for newer or more expensive vehicles.

Tips for Reviewing Auto Insurance Policies

- Compare coverage options from different insurance providers to ensure you are getting the best deal.

- Schedule policy reviews during key times of the year, such as when your policy is up for renewal or after major life changes.

- Request discounts or adjust coverage based on changes in your driving habits, location, or vehicle value.

Table comparing coverage options from different insurance providers

| Insurance Provider | Basic Coverage | Comprehensive Coverage |

|---|---|---|

| Provider A | $300 deductible | $0 deductible, rental car coverage |

| Provider B | $500 deductible | $100 deductible, roadside assistance |

Customer Satisfaction and Reviews of Low-Cost Auto Insurance Companies

Customer satisfaction plays a crucial role in selecting the right auto insurance provider. It not only reflects the quality of service but also indicates how well the company handles claims and customer inquiries.

Researching and Evaluating Reviews of Insurance Companies

- Check reputable review websites: Websites like J.D. Power, Consumer Reports, and the National Association of Insurance Commissioners provide valuable insights into customer experiences with different insurance companies.

- Read customer feedback: Look for common themes in reviews, paying attention to aspects like customer service, claims processing, and overall satisfaction.

- Consider ratings and rankings: Companies with high ratings and rankings are more likely to offer reliable and satisfactory services.

Importance of Customer Feedback in Selecting an Insurance Option

- Customer feedback can give you a glimpse into how a company treats its policyholders.

- Positive reviews can indicate a company’s commitment to customer service and claims handling.

- Negative reviews can alert you to potential issues such as claim denials, delays, or poor communication.

Conclusion

As we conclude our exploration of low cost auto insurance in the United States, remember that finding the right coverage at the best price is possible with the right knowledge and approach. Keep these valuable tips in mind as you navigate the world of auto insurance to ensure you always have the coverage you need at a price you can afford.

Essential FAQs

What does low-cost auto insurance mean?

Low-cost auto insurance refers to affordable coverage options that provide necessary protection for your vehicle at a budget-friendly price.

How can I lower my auto insurance premiums?

You can lower your auto insurance premiums by bundling policies, raising deductibles, maintaining a clean driving record, and exploring discounts offered by insurance providers.

Are there state-specific grants to help reduce insurance costs?

Some states offer grants or subsidies to drivers to help reduce insurance costs. Check with your local insurance department for more information on available programs.

What factors influence auto insurance rates?

Factors such as age, location, driving record, vehicle type, and coverage options can all impact auto insurance rates.

Can I exclude optional coverage to reduce costs?

Yes, you can exclude optional coverage to reduce costs, but make sure you understand the implications and ensure you have adequate protection for your needs.