Car insurance rates comparison in United States sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with entertaining interactive style and brimming with originality from the outset. Are you ready to dive into the world of car insurance rates and uncover the secrets to saving big?

Let’s get started!

Are you tired of overpaying for car insurance? Want to know how you can compare rates like a pro and secure the best deal possible? Look no further, as we take you on a journey through the ins and outs of car insurance rates comparison in the United States.

Get ready to unlock the keys to significant savings and make informed decisions about your coverage.

Overview of Car Insurance Rates Comparison in the United States

Car insurance rates can vary significantly depending on various factors, making it essential for drivers to compare rates from different providers. By comparing car insurance rates, individuals can save money and ensure they have the right coverage for their needs.

Factors Influencing Car Insurance Rates

- Driving Record: A clean driving record typically results in lower insurance rates, while a history of accidents or traffic violations can increase premiums.

- Location: Where you live can impact your insurance rates, with urban areas often having higher rates due to increased traffic and crime rates.

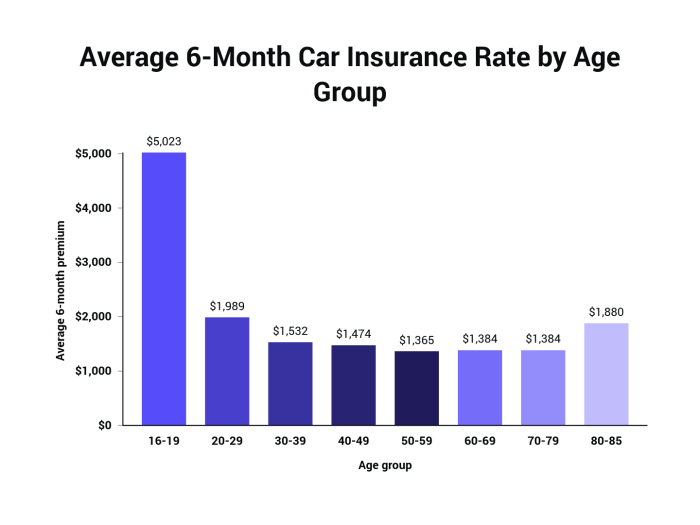

- Age: Younger drivers tend to pay higher insurance rates due to their lack of driving experience and perceived higher risk.

- Type of Vehicle: The make and model of your vehicle, as well as its safety features, can influence insurance rates.

Benefits of Comparing Rates

- Save Money: By comparing rates, you can find the most affordable option that still provides adequate coverage.

- Customized Coverage: Comparing rates allows you to tailor your insurance policy to meet your specific needs.

- Better Customer Service: Researching different providers can help you find one with a reputation for excellent customer service.

How to Conduct a Thorough Comparison

- Research Providers: Look into several insurance companies to compare their rates and reputation.

- Assess Coverage Options: Understand the different types of coverage available, such as liability, collision, and comprehensive.

- Get Quotes: Request quotes from at least three different providers for the same level of coverage to make a fair comparison.

- Review Discounts: Inquire about discounts that may be available to you, such as safe driver discounts or bundling policies.

Sample Comparison Table

| Insurance Provider | Annual Premium |

|---|---|

| Provider A | $1,200 |

| Provider B | $1,000 |

| Provider C | $1,300 |

Impact of Driver Profile on Rates

Driving record, location, age, and type of vehicle all play a significant role in determining insurance rates. Improving your driving record, choosing a safer vehicle, and looking for discounts can help lower your premiums.

Types of Car Insurance Coverage

When it comes to car insurance in the United States, there are several types of coverage options available to drivers. Each type of coverage serves a different purpose and provides protection in various scenarios. Let’s take a closer look at the different types of car insurance coverage and their significance.

Liability Coverage

Liability coverage is mandatory in most states and helps cover the costs associated with injuries and property damage that you are responsible for in an accident. This coverage protects you from having to pay out of pocket for medical bills, legal fees, and property repairs for the other party involved in the accident.

Collision Coverage

Collision coverage helps pay for repairs to your own vehicle in the event of a collision with another vehicle or object, regardless of fault. This coverage is essential for protecting your car and ensuring that you can get back on the road quickly after an accident.

Comprehensive Coverage

Comprehensive coverage provides protection for your vehicle in non-collision incidents such as theft, vandalism, natural disasters, or hitting an animal. This coverage is crucial for safeguarding your car against a wide range of unpredictable events that could cause damage.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage steps in to cover expenses if you are involved in an accident with a driver who has insufficient or no insurance. This coverage ensures that you are still protected even if the at-fault driver cannot cover your medical bills or vehicle repairs.

Medical Payments Coverage

Medical payments coverage helps pay for medical expenses for you and your passengers after an accident, regardless of fault. This coverage can be particularly useful for covering ambulance rides, hospital stays, surgeries, and other medical costs that may arise from a car accident.

Rental Reimbursement Coverage

Rental reimbursement coverage helps cover the cost of a rental car if your vehicle is in the shop for repairs after an accident. This coverage ensures that you can still get around while your car is being fixed, without having to worry about additional transportation expenses.

Factors Influencing Car Insurance Rates

When it comes to determining car insurance rates, several factors come into play. Insurance companies consider various elements before setting the cost of your premium. Understanding these factors can help you make informed decisions when choosing the right coverage for your vehicle.

Driving Record

Your driving record plays a significant role in determining your car insurance rates. Insurance companies typically offer lower premiums to drivers with clean records and no history of accidents or traffic violations.

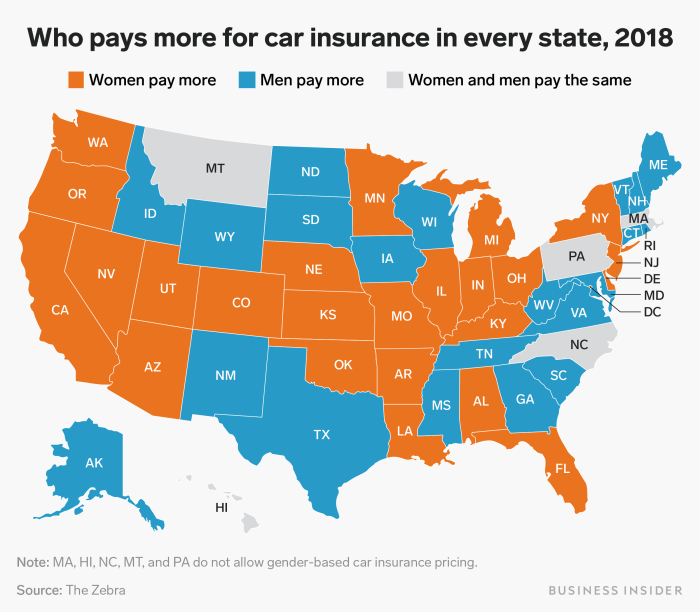

Age and Gender

Age and gender also influence car insurance rates. Younger drivers, especially teenagers, are considered high-risk drivers and may face higher premiums. Additionally, statistics show that male drivers tend to be involved in more accidents than female drivers, leading to differences in insurance costs.

Vehicle Make and Model

The type of car you drive can impact your insurance rates. Expensive or high-performance vehicles may come with higher premiums due to increased repair costs or theft rates. On the other hand, safety features and anti-theft devices can help lower insurance costs.

Location

Where you live can affect your car insurance rates as well. Urban areas with higher rates of accidents or thefts may result in higher premiums compared to rural areas. Additionally, factors like weather conditions and traffic congestion can also play a role in determining insurance costs.

Credit Score

Insurance companies often use credit scores to assess the risk profile of a driver. A higher credit score can lead to lower insurance rates, as it is believed to reflect responsible financial behavior and lower risk for the insurance provider.

Coverage Limits and Deductibles

The coverage limits and deductibles you choose can impact your insurance rates. Opting for higher coverage limits or lower deductibles may result in higher premiums, while choosing lower coverage limits or higher deductibles can help lower your insurance costs.

Annual Mileage

The number of miles you drive annually can also influence your car insurance rates. Drivers who commute long distances or use their vehicles frequently may face higher premiums compared to those who drive less frequently.

Marital Status

Married individuals may be eligible for lower car insurance rates compared to single drivers. Statistics show that married couples tend to be involved in fewer accidents, leading to potential discounts from insurance companies.

Discounts and Bundling

Insurance companies often offer discounts for various reasons, such as bundling multiple policies, having a good driving record, or completing defensive driving courses. Taking advantage of these discounts can help reduce your overall insurance costs.

How to Compare Car Insurance Rates

When it comes to comparing car insurance rates, there are several steps you can take to ensure you find the best coverage at the most affordable price. Utilizing online comparison tools, reviewing coverage limits, and deductibles are key components in this process.

Using Online Comparison Tools

- Start by entering your zip code and answering a few questions about your driving history and vehicle details.

- Receive quotes from multiple insurance companies in your area to compare rates side by side.

- Consider factors such as coverage options, discounts, and customer reviews when evaluating each quote.

Reviewing Coverage Limits and Deductibles

- Ensure that the coverage limits in each quote meet your state’s minimum requirements and provide adequate protection for your vehicle.

- Compare deductibles to see how they impact your premium and out-of-pocket costs in the event of a claim.

- Consider adjusting your coverage limits and deductibles to find a balance between affordability and comprehensive protection.

State-by-State Comparison of Car Insurance Rates

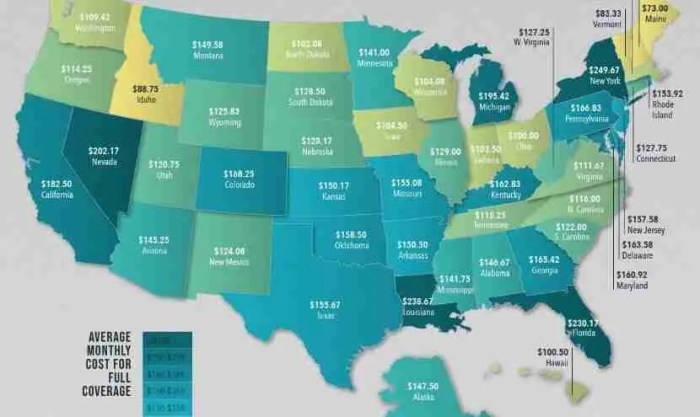

When it comes to car insurance rates, they can vary significantly from state to state in the United States. Factors such as population density, traffic congestion, and weather conditions can all impact the cost of car insurance.

Comparison of Average Car Insurance Rates by State

- California: The average annual car insurance premium for a sedan in California is $1,783. Coverage includes liability, comprehensive, and collision.

- Texas: A sedan in Texas has an average annual premium of $1,686, with similar coverage options as California.

- Florida: Florida’s average annual premium for a sedan is $2,219, which includes additional coverage for hurricanes and flooding.

- Ohio: The average annual premium for a sedan in Ohio is $1,034, with basic liability coverage.

- North Dakota: North Dakota has the lowest average premium for a sedan at $773, with coverage for liability and uninsured motorist.

Factors Influencing Car Insurance Rates by State

- Population Density: States with higher population density tend to have higher insurance rates due to increased risk of accidents.

- Traffic Congestion: Areas with heavy traffic congestion may see higher premiums as the likelihood of accidents is greater.

- Weather Conditions: States prone to severe weather events like hurricanes or snowstorms may have higher insurance rates to cover potential damages.

Impact of Driving History on Insurance Rates

When it comes to determining car insurance rates, one of the key factors that insurance companies consider is your driving history. Your past accidents, traffic violations, and claims history can have a significant impact on the rates you are offered.A clean driving record, free of accidents and traffic violations, is usually rewarded with lower insurance premiums.

This is because insurance companies see drivers with clean records as less risky to insure, and therefore offer them lower rates.

Examples of Impact

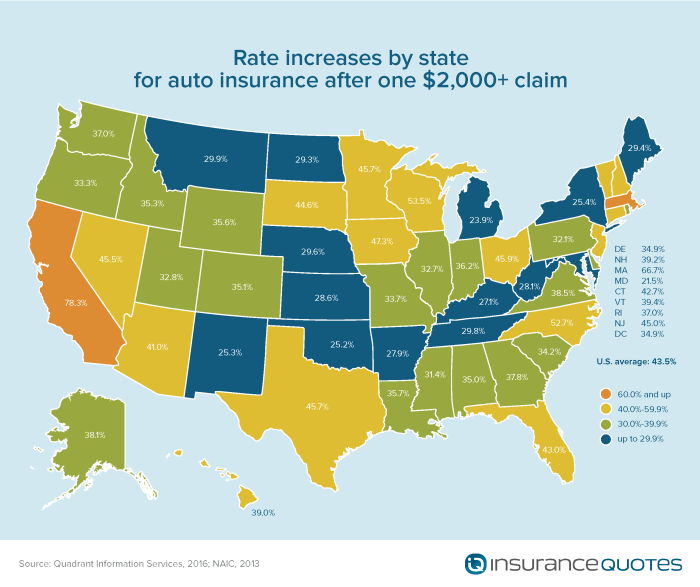

- Accidents: Being involved in accidents, especially if you are at fault, can lead to higher insurance rates. Insurance companies may see you as a higher risk driver and adjust your rates accordingly.

- Traffic Violations: Speeding tickets, reckless driving, and other traffic violations can also result in increased insurance rates. These violations indicate to the insurance company that you may not be a safe driver.

- Claims History: Making frequent insurance claims can also cause your rates to go up. Insurance companies may view you as more likely to make future claims, leading to higher premiums.

Strategies for Improvement

- Practice Safe Driving: Obey traffic laws, avoid distractions while driving, and always drive defensively to reduce the risk of accidents and violations.

- Take Defensive Driving Courses: Completing a defensive driving course can not only improve your driving skills but also potentially lead to lower insurance rates.

- Bundle Policies: Consider bundling your auto insurance with other types of insurance, such as homeowners or renters insurance, to potentially qualify for discounts.

Understanding Deductibles and Premiums

When it comes to car insurance, understanding deductibles and premiums is crucial in determining the overall cost of your coverage. Deductibles refer to the amount of money you agree to pay out of pocket before your insurance coverage kicks in, while premiums are the regular payments you make to your insurance company to maintain coverage.

Impact of Choosing a Higher Deductible vs. a Lower Deductible on Premiums

Choosing a higher deductible typically results in lower premiums, as you are agreeing to cover more of the cost of any potential claims. On the other hand, opting for a lower deductible means higher premiums since the insurance company will be covering more of the cost in the event of a claim.

Adjusting Deductibles and Overall Insurance Costs

Adjusting deductibles can have a significant impact on your overall insurance costs. By increasing your deductible, you can lower your premiums but will have to pay more out of pocket in the event of a claim. Conversely, lowering your deductible will increase your premiums but reduce the amount you need to pay upfront if you file a claim.

Detailed Example Scenario

For example, let’s say you have a $500 deductible and pay $1000 in premiums annually. If you increase your deductible to $1000, your premiums may decrease to $800. This means you save $200 on premiums but will have to cover the additional $500 in case of a claim.

Premium Calculation and Coverage

Premiums are calculated by insurance companies based on various factors such as your age, driving record, location, and the coverage options you choose. The premium represents the cost of your insurance coverage for a specific period, usually a year.

Factors to Consider in Choosing Deductible Amount

When deciding on an appropriate deductible amount for your car insurance policy, consider factors such as your financial situation, driving habits, and the value of your car. It’s essential to find a balance between a deductible that lowers your premiums while still being manageable in the event of a claim.

Table: Potential Savings or Additional Costs with Various Deductible Options

| Deductible Amount | Premium Cost | Out-of-Pocket Cost in Case of Claim |

|---|---|---|

| $500 | $1000 | $500 |

| $1000 | $800 | $1000 |

| $1500 | $700 | $1500 |

Discounts and Savings Opportunities

When it comes to car insurance, taking advantage of discounts and savings opportunities can help you lower your premiums and save money. Let’s explore some common ways to reduce your insurance costs.

Common Discounts Offered by Car Insurance Companies

- Multi-policy discount for bundling auto and home insurance

- Good driver discount for maintaining a clean driving record

- Good student discount for young drivers with good grades

- Safety feature discount for having anti-theft devices or lane departure warning systems

- Loyalty discount for staying with the same insurance company for a certain period

Bundling Policies for Significant Savings, Car insurance rates comparison in united states

Combining your auto and home insurance policies with the same company can lead to significant savings through a multi-policy discount. By bundling your policies, insurance companies often offer lower premiums, making it a cost-effective option for coverage.

Safe Driving Courses for Insurance Premium Reduction

Completing safe driving courses can help reduce your insurance premiums by demonstrating your commitment to safe driving practices. These courses provide valuable knowledge and skills that can make you a lower-risk driver in the eyes of insurance companies, resulting in potential discounts on your premiums.

Impact of Vehicle Safety Features on Insurance Costs

Installing advanced safety features like anti-theft devices or lane departure warning systems can positively impact your insurance costs. These features reduce the risk of accidents or theft, making your vehicle safer to insure and potentially qualifying you for discounts on your premiums.

Maximizing Savings by Combining Discounts

To achieve the maximum reduction in insurance rates, it’s essential to effectively combine multiple discounts offered by car insurance companies. By taking advantage of various discounts such as multi-policy, good driver, and safety feature discounts simultaneously, you can optimize your savings and lower your overall insurance costs.

Comparison of National Insurance Providers: Car Insurance Rates Comparison In United States

When it comes to choosing a car insurance provider in the United States, it’s essential to compare major national insurance companies based on coverage options and rates. Each provider offers different benefits and services, so understanding the key differences between them can help you make an informed decision.

Hey there, world explorers! Are you ready to say Hello world! and embark on new adventures? The world is full of wonders waiting to be discovered, so why not start now? Whether you’re a seasoned traveler or a newbie, there’s always something exciting out there just waiting for you to uncover.

So, what are you waiting for? Say hello to the world and let the journey begin!

Additionally, looking into customer reviews and ratings for the top insurance companies can give you insight into their customer service and claims process.

State Farm

State Farm is known for its excellent customer service and a wide range of coverage options. They offer competitive rates and have a user-friendly claims process. Many customers appreciate their personalized approach to insurance.

GEICO

GEICO is popular for its affordable rates and convenient online tools. They provide various discounts for policyholders and have a straightforward claims process. Customers often praise GEICO for its easy-to-use website and mobile app.

Progressive

Progressive is well-known for its innovative Snapshot program, which rewards safe drivers with lower rates. They offer a variety of coverage options and discounts, making it a popular choice for many drivers. Customers often mention Progressive’s quick claims process and helpful customer service.

Hey there, ready to conquer the digital world? If you’re new to programming, the first thing you’ll encounter is the classic phrase ” Hello world! “. It’s like a rite of passage for all aspiring coders. So, embrace it with open arms and get ready to dive into the exciting world of coding!

Allstate

Allstate is recognized for its extensive network of agents and customizable coverage options. They offer various discounts for policyholders and have a user-friendly claims process. Customers appreciate Allstate’s personalized approach to insurance and the peace of mind it provides.

Nationwide

Nationwide is praised for its reliable customer service and a wide range of coverage options. They offer competitive rates and discounts for policyholders. Many customers choose Nationwide for its comprehensive coverage and easy claims process.

Impact of Vehicle Type on Insurance Rates

When it comes to car insurance rates, the type of vehicle you drive plays a significant role in determining how much you’ll pay for coverage. Insurance companies consider various factors related to your vehicle when calculating premiums. Let’s explore how the make, model, and year of your car can influence your insurance rates.

Vehicle Safety Ratings

Vehicle safety ratings are an essential factor in determining insurance premiums. Cars with high safety ratings are less likely to be involved in accidents, leading to lower insurance costs. On the other hand, vehicles with poor safety ratings may result in higher premiums due to the increased risk of injuries and damages.

- Insurance costs for vehicles with top safety ratings are generally lower compared to those with lower safety ratings.

- Newer vehicles equipped with advanced safety features tend to have lower insurance premiums.

- Vehicles with good crash test ratings are considered safer to drive, resulting in lower insurance rates.

Vehicle Horsepower and Insurance Premiums

The horsepower of a vehicle can also impact insurance rates. High-performance cars with powerful engines are more likely to be involved in accidents, leading to higher insurance premiums. Insurance companies often charge more to insure vehicles with high horsepower due to the increased risk of speeding and reckless driving.

High-performance sports cars typically have higher insurance premiums compared to economy cars due to their horsepower and speed capabilities.

Fuel Efficiency and Insurance Rates

The fuel efficiency of a vehicle can affect insurance rates as well. Cars that are fuel-efficient are often less expensive to insure since they are perceived as safer and more environmentally friendly. Insurance companies may offer discounts to drivers of fuel-efficient vehicles as they are considered less risky to insure.

- Hybrid and electric vehicles are known for their fuel efficiency and may qualify for lower insurance premiums.

- Insurance companies may provide discounts to policyholders who drive eco-friendly cars with high fuel efficiency ratings.

Impact of Luxury Vehicles on Insurance Costs

Luxury vehicles typically come with higher insurance costs due to their expensive parts and repair costs. Insurance companies consider luxury cars to be more costly to insure since they require specialized repairs and maintenance. Drivers of luxury vehicles may face higher premiums compared to those driving standard or economy cars.

Owners of luxury vehicles often pay more for insurance coverage to protect against the higher costs associated with repairs and replacements of luxury car components.

Vehicle Modifications and Insurance Pricing

Modifying your vehicle can have a significant impact on insurance pricing. Adding aftermarket parts or making performance enhancements to your car can increase insurance premiums. Insurance companies may view modifications as increasing the risk of accidents or theft, resulting in higher costs for coverage.

- Custom modifications such as turbochargers or spoilers can lead to higher insurance rates.

- Inform your insurance provider about any modifications to your vehicle to ensure you have the appropriate coverage.

Tips for Negotiating Better Rates

When it comes to negotiating better car insurance rates, there are several strategies you can employ to potentially lower your premiums and save money. It’s important to be proactive and take the time to review your policy annually, as well as shop around for better deals to ensure you’re getting the best rate possible.

Loyalty and Good Credit

Being a loyal customer to your insurance provider can sometimes work in your favor when negotiating rates. Many insurance companies offer discounts to long-term customers, so it’s worth mentioning how long you’ve been with them and inquiring about any loyalty discounts that may be available.

Additionally, having a good credit score can also help you negotiate better rates. Insurance companies often take credit history into account when determining premiums, so maintaining a good credit score can potentially lead to lower insurance costs.

Annual Policy Review

Reviewing your policy annually is crucial to ensure you’re not paying for coverage you no longer need or missing out on potential discounts. Take the time to go over your policy details with your provider and ask about any available discounts or adjustments that can be made to lower your rates.

Comparison Shopping

Don’t be afraid to shop around and compare rates from different insurance providers. Getting quotes from multiple companies can help you identify the best deal and potentially negotiate with your current provider for a better rate. Remember, competition among insurers can work in your favor as they strive to offer you the most competitive price.

Understanding Fine Print in Insurance Policies

When it comes to car insurance policies, understanding the fine print is crucial to avoid any surprises or misunderstandings in the future. The fine print contains important details about coverage, exclusions, limitations, and other key terms that can impact your insurance protection.

Common Exclusions and Limitations

- One common exclusion in insurance policies is the “act of God” clause, which typically excludes coverage for natural disasters like earthquakes or floods.

- Another limitation to be aware of is the “wear and tear” exclusion, which means that the insurance may not cover damage caused by regular use or aging of the vehicle.

- Policyholders should also watch out for limitations on coverage for rental cars, personal belongings in the car, or specific types of modifications to the vehicle.

Tips for Interpreting Complex Insurance Terms

- Take your time to read through the policy document carefully and don’t hesitate to ask questions if you come across any terms or clauses that are unclear.

- Look for definitions of key terms in the policy’s glossary section to ensure you understand the specific meanings within the context of your coverage.

- Consider seeking advice from an insurance agent or professional if you need help deciphering complex legal language or technical jargon in the policy.

Impact of Location on Insurance Rates

Living in different locations can significantly impact car insurance rates in the United States. Factors such as population density, crime rates, weather conditions, and traffic congestion all play a role in determining how much you will pay for coverage.

Urban vs. Rural Areas

- Urban Areas: Car insurance rates tend to be higher in urban areas due to higher population density, increased traffic congestion, and greater risk of accidents and theft.

- Rural Areas: On the other hand, living in rural areas typically results in lower insurance rates as there is less traffic, lower crime rates, and a lower likelihood of accidents.

Regional Disparities in Insurance Costs

- Comparing regions: Insurance costs can vary significantly between regions in the U.S. For example, states with higher population densities and crime rates like California or New York tend to have higher insurance premiums compared to states with lower population densities like Montana or Wyoming.

- Weather Impact: Regions prone to severe weather conditions such as hurricanes or snowstorms may also experience higher insurance rates due to increased risk of damage to vehicles.

- Traffic Congestion: Areas with heavy traffic congestion, like major cities, may have higher insurance rates as the likelihood of accidents and vehicle damage is greater.

Importance of Regularly Reviewing Insurance Policies

Regularly reviewing your car insurance policies is crucial to ensure that you have adequate coverage at the best possible rates. Life changes and evolving needs can impact your insurance requirements, making it essential to revisit your policies periodically.

Checklist for Reviewing Insurance Coverage

- Evaluate your current coverage limits and assess if they still meet your needs.

- Consider any life changes, such as moving, getting married, or buying a new car, that may necessitate policy updates.

- Review policy exclusions and limitations to understand what is and isn’t covered.

- Check for any discounts or savings opportunities you may be eligible for.

Impact of Life Changes on Insurance Needs

Life changes can significantly impact your insurance needs. For example, adding a new driver to your policy or purchasing a more expensive vehicle may require adjustments to your coverage limits. It’s important to update your policy to reflect these changes accurately.

Comparing Insurance Quotes for Comprehensive Coverage

- Obtain quotes from multiple insurance providers to compare coverage options and rates.

- Ensure that you are comparing similar coverage levels when evaluating quotes.

- Consider bundling options or discounts to save on insurance costs.

Understanding the Role of Deductibles

Deductibles play a significant role in determining your insurance premiums. By adjusting your deductibles, you can influence the cost of your policy. However, it’s essential to strike a balance between your deductible amount and premium costs.

Leveraging Discounts and Bundling Options

During your policy review, take advantage of any discounts or bundling options offered by insurance providers. Bundling your home and auto insurance or maintaining a clean driving record can help you secure lower rates and maximize savings on your premiums.

Future Trends in Car Insurance Rates

The car insurance industry is constantly evolving, and several emerging trends are poised to impact insurance rates in the future. From advancements in technology to changing consumer behaviors, various factors will influence how insurance companies assess risk and determine premiums.

Influence of Technology on Insurance Pricing

Technology is playing a significant role in shaping the future of car insurance rates. Telematics, which involves the use of devices to monitor driving behavior, allows insurance companies to offer usage-based insurance policies. This trend is likely to continue, with safer drivers enjoying lower premiums based on actual driving habits.

Autonomous vehicles are also expected to impact insurance rates, as the shift towards self-driving cars could potentially reduce accidents and claims, leading to lower premiums for owners of autonomous vehicles.

Impact of Climate Change and Government Regulations

With the increasing frequency and severity of natural disasters linked to climate change, insurance companies may need to adjust their rates to account for higher risks of damage and claims. Government regulations related to environmental standards and safety requirements could also influence insurance rates, especially for vehicles that do not meet the mandated criteria.

Role of Big Data and Artificial Intelligence

Big data and artificial intelligence are revolutionizing the way insurance companies assess risk and set premiums. By analyzing vast amounts of data, insurers can better predict potential losses and adjust rates accordingly. AI algorithms can help in identifying patterns and trends, allowing for more personalized pricing based on individual risk profiles.

Shift towards Usage-Based Insurance

Usage-based insurance, which calculates premiums based on actual vehicle usage, is gaining popularity among insurers and consumers. This approach incentivizes safe driving habits and provides an opportunity for policyholders to lower their insurance costs through responsible behavior. As more drivers opt for usage-based insurance, traditional pricing models may undergo significant changes.

Impact of Ride-Sharing and Car-Sharing Programs

The rise of ride-sharing services and car-sharing programs has introduced new challenges for the insurance industry. Insurers are adapting to cover drivers who use their personal vehicles for commercial purposes, leading to adjustments in rates and coverage options. The evolving landscape of mobility services could reshape how insurance is priced and distributed in the future.

Cybersecurity Threats and Data Breaches

As vehicles become increasingly connected and reliant on digital systems, the risk of cybersecurity threats and data breaches poses a significant concern for insurers. Protecting sensitive information and ensuring the security of connected vehicles will be crucial in mitigating potential losses and maintaining affordable insurance rates for policyholders.

Usage-Based Insurance and Policy Pricing

The shift towards usage-based insurance, driven by advancements in technology and changing consumer preferences, is expected to have a profound impact on policy pricing. By offering more flexible and personalized coverage options, insurers can attract a wider range of customers and adapt to emerging trends in the market.

This transition towards usage-based insurance has the potential to revolutionize the way car insurance rates are determined and provide greater transparency for policyholders.

Final Thoughts

As we conclude our exploration of car insurance rates comparison in the United States, it’s clear that knowledge is power when it comes to securing the best deal. By understanding the key factors that influence rates, comparing coverage options, and leveraging discounts, you can take control of your insurance costs.

Remember, the more informed you are, the better equipped you’ll be to find the perfect policy at the right price.

FAQ

What factors can impact car insurance rates in the United States?

The driving record, location, age, and type of vehicle can all have a significant impact on insurance rates.

How can I effectively compare car insurance rates?

You can compare rates by researching different providers, understanding coverage options, and using online comparison tools to find the best deals.

Are there specific discounts available for car insurance in the United States?

Yes, there are common discounts offered by insurance companies, such as bundling policies, completing safe driving courses, and installing safety features in your vehicle.